Three of the biggest names in today’s technology sector, Amazon.com, Inc. (NASDAQ:AMZN), Apple Inc. (NASDAQ:AAPL), and Netflix, Inc. (NASDAQ:NFLX), are well-positioned for future growth – each for different reasons. One of these companies is willing to sacrifice margins in favor of investments. One is patiently staying the course with proven products and cash reserves that could foretell an acquisition spree. And one is the clear leader in a space becoming crowded with “me too” imitators – all of which appear doomed to be playing catch-up for the foreseeable future.

Here is a quick snapshot of all three.

Amazon’s investments and their effect on investors

The cause? More of Amazon’s capital investments, when you really cut to the chase.

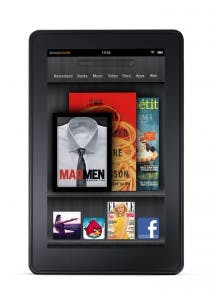

As usual, Amazon.com, Inc. (NASDAQ:AMZN) isn’t being shy when it comes to bolstering its infrastructure. The company’s latest outlays have to do with adding physical distribution centers aimed at ever-faster order fulfillment; that, and its dabbling in the tablet market with the Kindle Fire as well as content development via television production and the like.

On April 25, the company reported that first-quarter revenue jumped 22% to slightly more than $16 billion, which missed analyst’s expectations by about $90 million. Profits dropped $0.10 per share compared to the same period last year. Net income dropped $48 million in total from $130 million in Q1 2012 to $82 million in the most recent Q1.

A roller-coaster ride, indeed. The company’s answer? Get used to it – because according to CEO Jeff Bezos, Amazon.com, Inc. (NASDAQ:AMZN) won’t be stemming its tide of investments anytime soon. And from my perspective, there isn’t anything wrong with that.

I see Amazon’s willingness to invest in additional infrastructure as a good thing. After all, Amazon has invested in an “ahead of the curve” kind of way since the company’s inception. Jeff Bezos is also famously (and repeatedly) quoted as a CEO with a very “long” vision – and he’s proved critical analysts wrong time and time again.

Speaking of analysts, this time around they appear to be on Amazon.com, Inc. (NASDAQ:AMZN)’s side. Thompson/First Call has the current tally of 33 brokers showing a median price target of $320 per share. The stock is currently trading at substantially the same price ($253/share) it did Jan. 1, and investors will recall its steady climb that month to its 2013 high of over $284 per share.

I tend to share the long-term vision embraced by Jeff Bezos, and see Amazon heading back to the $290 range well before it sees $220 again.

Where is Apple’s stock headed next?

It’s been over a quarter year since Apple Inc. (NASDAQ:AAPL) seriously flirted with the $500 per-share mark, and by now investors are surely asking if the heady days of the stock’s $705 high (posted in September of last year) are apt to return anytime soon.

Even if many analysts suggest it’s probably not, it would be a big mistake to underestimate Apple. Yes, there is fresh competition coming at Apple from all directions, but nevertheless, the company still sets the standard for the world’s most cherished gadgets.

Consider the following:

Big chunks of Apple Inc. (NASDAQ:AAPL)’s profitability comes from the juggernaut we know as the iPhone, and it would be foolish to assume the iPhone’s popularity is about to crumble. In fact, a recent Yankee Group survey cited by MacRumors.com revealed that 91% of iPhone respondents plan to stick with Apple when upgrades become available. Conversely, just 76% of Android users who responded to the survey plan to remain with the Android platform at the next upgrade interval.

Analysts and the media are quick to criticize Apple Inc. (NASDAQ:AAPL), suggesting that no “set- the-world-on-fire” or “wait-in-line-overnight” products are anticipated to be launched in the near future. However, the iPad continues to see a blazing sales pace, with nearly 8 million more units sold in its second 2013 fiscal quarter than a year ago. With numbers like that, it would appear that plenty of people were standing in line for the iPad Mini.

According to numerous reports near the end of March, the company is sitting on cash reserves approaching $140 billion. Some analysts suggest that money could be put to better use than sitting around earning interest at today’s paltry rates – and they may be right. However, being awash in cash is never a very big problem for a business, is it?

Add it all up, and what do you have? A company whose customers are fiercely loyal, with products that have proven staying power and the cash to back the next bright innovation – or acquisition. Don’t be surprised if Apple Inc. (NASDAQ:AAPL) heads north of $500 per share into the summer months – a contention supported by the latest ratings from 28 different firms (from Barclays PLC (ADR) (NYSE:BCS) to JPMorgan Chase & Co. (NYSE:JPM) to UBS AG (USA) (NYSE:UBS)) – which issued strong buy recommendations at a rate outpacing Buy or Hold by a margin of better than three to one.

Netflix – Back to $300 by summer?

With an impressive leap of 32% after an equally impressive earnings report in recent days, are Netflix, Inc. (NASDAQ:NFLX) shares heading back to their all-time high this year?

That mark was achieved in July 2012 when the stock reached $300, and it’s certainly possible the company could see similar performance again. Considering that Netflix grew 17% in its last quarter (compared to the same period last year), I think the company is weathering the “me too” storm of competition it’s facing very well. From Google Inc (NASDAQ:GOOG) to Hulu Plus, there are some formidable players trying to unseat Netflix as the streaming video leader.

If many more join the fray, the space is going to get overcrowded soon – which might force a consolidation philosophy that could very well benefit Netflix, Inc. (NASDAQ:NFLX) as a prime acquisition target. Furthermore, Netflix is projecting that it will cross the 30-million subscriber mark this year, which will serve to cement its position as the market leader.

The bottom line: Netflix appears to be solidifying its customer base at a time when its primary competitors are still stretching to become more relevant. And if that trend continues, $300 per share in time for the next earnings report seems a very distinct possibility.

For all three of these companies, the future continues to look bright. From my perspective, investors who are looking to shore up their tech holdings can find themselves in a strong position with well-placed investments in Amazon.com, Inc. (NASDAQ:AMZN), Apple Inc. (NASDAQ:AAPL) and/or Netflix.

The article Three Tech Giants Poised for Further Growth originally appeared on Fool.com and is written by Naomi Warmate-Igwe.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.