When most people talk about the electronic health record, or EHR, market, they tend to speak in terms of forward projections. They focus on the projection that the North American health care IT market will grow at a compound annual growth rate of 7.4% to $31.3 billion by 2017. They also point out that the U.S. government’s HITECH legislation, started in 2009, will continue funding these businesses as medical practices are offered incentives to make “meaningful use” of their EHR services.

Shrewd investors, however, should know that forward growth projections are often far rosier than they actually are. Therefore, in our zeal to discuss the latest mobile EHR apps, speech recognition software, and biometrics technology in health care IT, we shouldn’t neglect the basis of all solid, long-term investments — the fundamentals.

In this article, I’ll take a look at the fundamental growth of three leading EHR companies — Allscripts Healthcare Solutions Inc (NASDAQ:MDRX), Cerner Corporation (NASDAQ:CERN), and athenahealth, Inc (NASDAQ:ATHN) — and how much scaffolding supports each one.

Market share growth

Allscripts Healthcare Solutions Inc (NASDAQ:MDRX), Cerner Corporation (NASDAQ:CERN), and athenahealth, Inc (NASDAQ:ATHN) are three publicly traded companies that rank in the top ten EHR companies by market share. General Electric and McKesson are also major public players in the health care IT field, but both businesses are more diversified. Privately held Epic is the market leader in larger practices, while Practice Fusion is the fastest growing company in the industry.

A look at the market share growth in the ambulatory electronic medical record, or EMR, market between July 2012 and May 2013 reveals that only Practice Fusion, athenahealth, Inc (NASDAQ:ATHN), Epic, and Cerner Corporation (NASDAQ:CERN) reported positive market growth.

| Company | July 2012-May 2013 Market Share Growth | Total Overall Market Share |

| Practice Fusion | +53% | 5.8% |

| athenahealth | +35% | 2.3% |

| Epic | +6% | 10.3% |

| Cerner | +3% | 3.5% |

| Allscripts | -11% | 10.6% |

Sources: Practicefusion.com, SK&A

While it’s clear that athenahealth, Inc (NASDAQ:ATHN) is the fastest growing publicly traded EHR company, its market share still trails its larger peers by a wide margin. Allscripts Healthcare Solutions Inc (NASDAQ:MDRX), on the other hand, has lost significant market share over the past year, despite extensive partnerships which include collaborations with tech giant Cisco and drugstore chain CVS Caremark.

The Foolish fundamentals

Now that we’ve established which companies are growing and which are shrinking, we should compare their fundamental valuations.

| 5-year PEG | Trailing P/E | Price to Sales | Price to Book | Debt to Equity | Profit Margin | |

| athenahealth | 3.79 | 17,818.33 | 7.97 | 11.76 | 73.57 | 0.09% |

| Cerner | 1.89 | 37.67 | 5.86 | 5.39 | 6.16 | 15.99% |

| Allscripts | 4.76 | N/A | 1.90 | 1.95 | 39.86 | -3.52% |

| Advantage | Cerner | Cerner | Allscripts | Allscripts | Cerner | Cerner |

Source: Yahoo! Finance, as of Aug. 29.

Fundamental investors should immediately notice some major problems with athenahealth, Inc (NASDAQ:ATHN) — its whopping P/E, P/S, and P/B ratios all suggest that the stock is grossly overvalued. Its 5-year PEG ratio of 3.79 also suggests sluggish growth ahead. Moreover, the company’s paper-thin margins and high debt-to-equity ratio are major red flags. Allscripts Healthcare Solutions Inc (NASDAQ:MDRX) has some major problems as well — a five-year forecast for sluggish growth, a lack of profitability, and negative margins.

Cerner Corporation (NASDAQ:CERN), on the other hand, has more stable valuations than either athenahealth or Allscripts Healthcare Solutions Inc (NASDAQ:MDRX), but the disparity between its PEG ratio and trailing P/E suggests limited upside from current levels. It also has robust double-digit margins in an industry plagued by negative profit growth.

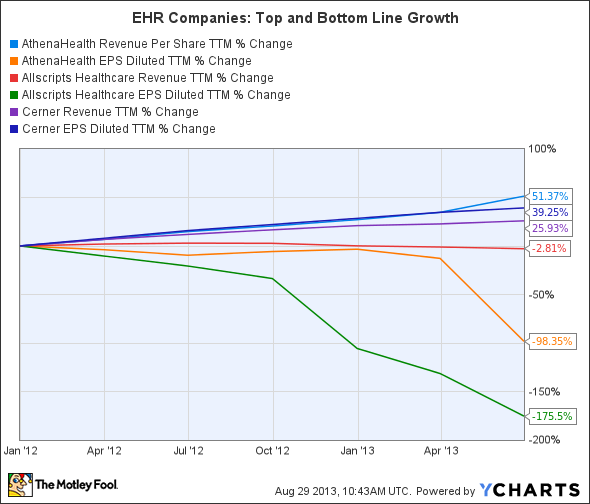

A look at the top and bottom line growth of these three companies also confirms the fact that only Cerner Corporation (NASDAQ:CERN) has been able to preserve its top and bottom line growth over the past two years.