The story with the industrial sector in this earnings season has been that there has been great variability in performance. It is very much a sector picker’s market, and the broad based industrial plays like General Electric Company (NYSE:GE) or Alcoa Inc (NYSE:AA) have reported this theme. In short, Europe has been weak, but China has rebounded somewhat, the US is doing okay and the areas of relative strength overall are in things like housing, autos and aerospace. With this understood, is there a company with good exposure to these sectors?

PPG to the Rescue

I think PPG Industries, Inc. (NYSE:PPG) might fit the bill, and based on the share price graph the market seems to think so too. I last discussed the company in an article linked here and back then concluded that there was some uncertainty over China. Since then things have picked up a bit in China (at least in the industries that PPG Industries, Inc. (NYSE:PPG) is focused on), and it has completed a few notable transactions.

The industrial sector is certainly not firing on all cylinders but by looking at Alcoa Inc (NYSE:AA)’s last results it is clear that some segments are doing better than others. However, with a stock like Alcoa Inc (NYSE:AA), it really is dependent on broad based industrial output in China.

So what makes PPG Industries, Inc. (NYSE:PPG) different?

I have a list of reasons to like the stock:

Its exposure to automotive, aerospace and packaging has led it to outperform the industrial market this year.

The restructuring program has led to the company expanding margins with productivity improvements.

Some of its raw material costs appear to be moderating in 2013.

Even with weakness in European autos (see Alcoa Inc (NYSE:AA)) PPG managed to do relatively well thanks to its ‘good customer mix’.

The sale of its commodity chemicals business will allow it to focus on its core activities.

The acquisition of Akzo Nobel’s US household paints division is a good move given the nascent housing recovery and the $200 million of synergy savings that it thinks it can generate in the next three years.

Putting these things together leads to an attractive proposition for 2013. In addition, China has been doing better recently in the sectors that matter to PPG.

How PPG Makes its Money

Having conceptually discussed the positive tailwinds for the company, it’s time to look at how this translates into earnings. Here is a breakdown of its segmental earnings:

And now consider that it has more than doubled the size of its US architectural coatings business with the purchase of Akzo Nobel US household paints division.

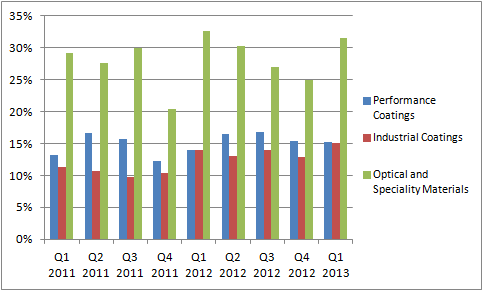

For evidence of how well margins have expanded, I want to focus on the profit margins in its three largest businesses.

Note how well performance coatings and industrial coatings are expanding (don’t forget to look at them on a year on year basis).

There could be more to come with raw material costs moderating. PPG Industries, Inc. (NYSE:PPG)’s management were relatively cautious over the issue, but if we go back to Sherwin-Williams Company (NYSE:SHW)‘ last results, it reduced its view on raw material cost inflation for the year. Indeed, Sherwin-Williams Company (NYSE:SHW) reduced its view to flat from low single digits previously. Titanium dioxide and propylene prices may see some pressure as other parts of the industrial sector are not doing so well, and since these are key inputs into PPG Industries, Inc. (NYSE:PPG)’s cost base, I think there is reason to be optimistic.

The Bottom Line

In conclusion this company has a lot of things going for it. It’s a mixture of acquisition-led growth plus good exposure to the parts of the industry that are working right now. In addition, the increases in margin plus opportunities for synergy-driven cost savings mean that its (already substantial) cash generation can improve in future years. For those looking for exposure to an industrial cyclical then PPG Industries, Inc. (NYSE:PPG) looks to be one of the best options.

The article The Best Stock in the Industrial Sector? originally appeared on Fool.com.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.