Toward the end of 2011, I continuously said “short DDD.” My reason was due to valuation, as 3D Systems Corporation (NYSE:DDD) was among the best performing and most expensive stocks in the technology space. Yet after a steep pullback in March, my outlook changed, as I said to buy the stock. Now after earnings, I am very optimistic, and say that 3D Systems is a necessity to the portfolio of technology investors.

A Look at 3D Systems’ Quarter

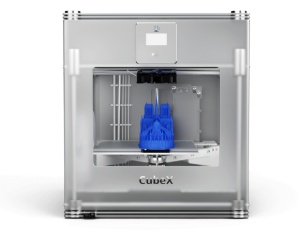

For the quarter, 3D Systems Corporation (NYSE:DDD) saw revenue of $102.1 million for growth of 31% year-over-year (yoy). The company’s most impressive segment was printer sales (no surprise), which grew an impressive 61% with 22.10% being organic growth. The company also achieved growth from new products, returning $38.3 million in this category, which was up 60% yoy. In addition, the company also saw greater demand in both Europe and Asia, as these two regions stole market share from North America.

Industry & Investment Outlook

| 3D Systems | Stratasys, Ltd. (NASDAQ:SSYS) | ExOne Co (NASDAQ:XONE) | |

|---|---|---|---|

| Market Cap (millions) | $3,500 | $3,200 | $500 |

| Forward P/E ratio | 29.78 | 34.50 | 58.00 |

| PEG Ratio | 1.30 | 1.32 | N/A |

| Price/Sales | 9.30 | 14.12 | 17.0 |

| Operating Margin | 18.57% | 15.11% | (28.17%) |

In my opinion, ExOne doesn’t fit into the conversation as a comparable company in terms of investment opportunity to either 3D Systems Corporation (NYSE:DDD) or Stratasys. While ExOne is promising and does operate in the 3D printing space, it is too small, its premium is too high, and it’s nowhere near reaching the efficiency of either 3D Systems or Stratasys, Ltd. (NASDAQ:SSYS). ExOne Co (NASDAQ:XONE) fits into the speculative realm with just $28.66 million in revenue over the last 12 months.

When you look at 3D Systems Corporation (NYSE:DDD) compared to Stratasys you should see two fast-growing companies that are leaders in a highly promising industry. For this fact, you have to award a higher premium to invest. These are established $3 billion plus companies that have been noticed by the market and therefore a PEG ratio that is 30% greater than the “true value” of 1.00 should be expected, and is tolerable when choosing to invest in a growth industry such as 3D printing.

As we look at the other two metrics, which I believe are most important to the sentiment of a stock, you see that 3D Systems is significantly more efficient in terms of margins and is also cheaper compared to revenue. With 3D Systems Corporation (NYSE:DDD), because of its revenue growth, I have no problem paying a price/sales near 10.0, but a near 50% premium for a company that I consider a notch below (Stratasys) is way too expensive. Thus I consider 3D Systems to be a great investment for this mere fact, combined with the data discussed from its earnings report.

Conclusion

In my opinion, 3D Systems Corporation (NYSE:DDD) has the perfect balance of growth and value to create substantial upside. While I do like Stratasys I also think it is too expensive. And although ExOne has a great deal of promise it is still too early to place such a large premium on the stock. Hence 3D Systems becomes the best choice, and because it has underperformed throughout 2013 (currently trading at $37.00) the stock is presenting upside potential.

The article Strong Earnings Validate Upside Potential in 3D originally appeared on Fool.com and is written by Brian Nichols.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.