Insider Monkey, your source for free insider trading data, likes Warren Buffett; he is one of the “insiders” this monkey imitates.

However, we don’t agree with him on hedge funds. Warren Buffett criticized hedge funds in 2006 with the following words:

“In 2006, promises and fees hit new highs. A flood of money went from institutional investors to the 2-and-20 crowd. For those innocent of this arrangement, let me explain: it’s a lopsided system whereby 2% of your principal is paid each year to the manager even if he accomplishes nothing – or, for that matter, loses you a bundle – and, additionally, 20% of your profit is paid to him if he succeeds, even if his success is due simply to a rising tide.

“…The inexorable math of this grotesque arrangement is certain to make the Gotrocks family poorer over time than it would have been had it never heard of these hyper-helpers. Even so, the 2-and-20 action spreads. Its effects bring to mind the old adage: When someone with experience proposes a deal to someone with money, too often the fellow with money ends up with the experience, and the fellow with experience ends up with the money”

It’s true that there are some fake hedge funds out there acting like mutual funds, taking on a lot of market risk and yet managing to trick their investors into surrendering 2% in administrative fees and 20% of the upside. This isn’t much different from Madoff tricking trusting old investors into believing that he can deliver 8-10% annual returns with no volatility. In reality, most prominent hedge funds operate quite differently and Warren Buffett knows this. He too was one of the first hedge fund managers who owed his wealth to similar pay practices. Here are the 5 reasons why Insider Monkey thinks Warren Buffett is wrong on hedge funds:

1. Warren Buffett is disturbed by the fact that a flood of investors are deserting institutional investors –who are literally index huggers- and going to hedge funds. Back in 1956, Warren Buffett himself had set up a hedge fund, attracted index hugging institutional fund investors, and operated nearly a dozen hedge funds (partnerships) until the end of 1969.

2. Warren Buffett implies that the 2-and-20 crowd can attract institutional investors with the snap of their fingers. The truth is nowhere near this. Most hedge fund investors are sophisticated enough to check the managers and their track record; and they won’t invest with hedge funds unless hedge funds can show them they can deliver abnormal returns (or alpha). Warren Buffett had trouble with raising money in 1956 (he had no track record) and only managed to get funds from family and friends. He now acts like that never happened.

3. Warren Buffett implies that it’s very easy to convince investors to accept a 2-and-20 arrangement. He had trouble convincing his own investors to accept high hedge fund performance fees and had to trick them by offering some “protection”. See how Warren Buffett convinced his skeptical investors.

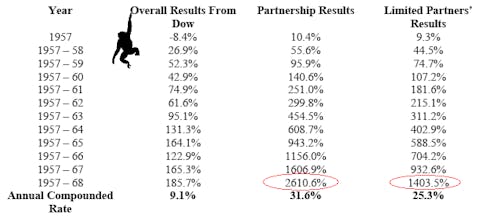

4. Warren Buffett claims that hedge funds do not deserve their fees because these fees could be the result of a rising tide. Good hedge funds do not take on market risk (beta); they only get fees for their skill (alpha). Their clients usually demand from them to hedge the market risk as a condition to providing the funds. Warren Buffett is a hypocrite because not only he did he take on significant market risk, but he also charged a 25% performance fee for the overall increases in the stock market (a.k.a rising tide). To be specific, between 1957 and 1968, Warren Buffett’s hedge fund returned an average of 32.4%. A full 19 percentage points of this was due to his outstanding skill, and 13.4% of this return was a result of the increase in the market (Insider Monkey used Fama and French’s three factor model and their annual data to calculate Warren Buffett’s alpha and beta). This means that Warren Buffett confiscated 3.35% (25% of 13.4%) of his clients’ funds every year simply because the market was going up. This is nearly half of all the fees Warren Buffett charged. Over 12 years Warren Buffett returned a compounded 2,600%, but his investors received only 1,400% because of all the fees Warren Buffett charged. If Warren Buffett didn’t charge any fees for the market risks he took on, his investors would have received around 2,000% instead.

5. Warren Buffett was using the Dow Jones Industrial Average as a benchmark in his investor letters even though he was investing in a much larger universe, such as small cap and distressed stocks. He was taking disproportional positions in some companies, investing in illiquid stocks, and investing in bankrupt companies. These strategies are currently employed by hedge funds and the DJIA was not a proper benchmark for Warren Buffett. He should have at least used the entire market as a benchmark. The DJIA underperformed the market by more than 2 percentage points between 1957 and 1968.