In an ultra low interest rate environment, high dividend stocks seem like a better bet than 10-year bonds that only yield 2.4%. AT&T is and has been one of the largest telecom stocks in the world and currently yields 5.92%. The current quarterly dividend is $0.42 per share and 10 years ago it was $0.254 per share. AT&T managed to increase its quarterly dividend by more than 60% over the past decade. Even if we assume that they only increase their dividend by the rate of inflation, AT&T can still beat 10-year bonds if it doesn’t decline by more than 5% per year. If AT&T trades above $14.18 in 2020, an investor would be better off investing in AT&T stock than in ten year treasury bonds.

Free insider trading data website Insider Monkey compiled the list of 5 stocks insiders are buying with at least $5 billion in market cap and 4% dividend yield. These stocks should beat 10-year treasuries unless there are substantial declines in stock prices and significant dividend cuts. Here are the five high dividend stocks insiders are buying:

1. Consolidated Edison Inc. (ED)

Several insiders are buying Consolidated Edison (ED) as part of their company’s stock purchase plan. The stock currently distributes $0.595 quarterly dividend, and they have been increasing the dividend by $0.005 per year since 1996. If the same pattern holds over the next ten years, the dividend should be around $0.645 in 2020. The stock currently trades at $48 with a dividend yield of 4.96%.

2. Kimberly-Clark Corporation (KMB)

A director of the company, W Robert Dechert, recently purchased 1,000 shares of Kimberly-Clark at $64 per share. The stock currently distributes $0.66 per share each quarter. The dividend has been consistently increasing from $0.27 in 2000 to $0.66 in 2010. The stock currently trades around $66 with a dividend yield of 4%.

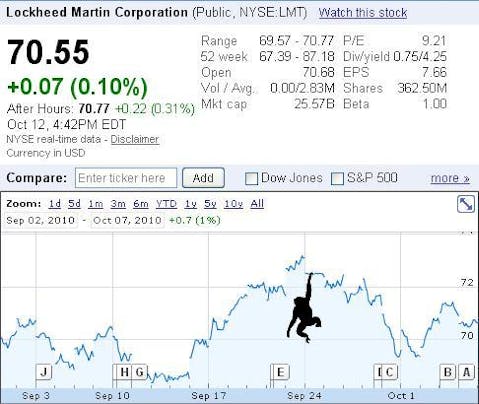

3. Lockheed Martin Corporation (LMT)

A director of Lockheed Martin, Thomas J Falk, recently purchased 5,000 shares at $73.02 per share. The stock currently trades even below this price ($70) and yields 4.29%. The board announced to increase quarterly dividend by 19% from $0.63 to $0.75. Even though Lockheed Martin’s dividend increased from $0.11 per share in 2000 to $0.75 in 2010, it declined before 2000.

4. Philip Morris International, Inc. (PM)

Sergio Marchionne, a director of Philip Morris International, recently purchased 1,500 shares of PM at $51.53 per share. The stock currently distributes $0.64 per share each quarter. The dividend has been consistently increasing since the stock’s debut in 2008. The stock currently trades at $57 and has a dividend yield of 4.5%.

5. SCANA Corp. (SCG)

The Chairman, President and CEO of Scana Corp, B. William Timmerman, purchased more than 29,000 shares at around $39 per share. The stock currently distributes $0.475 quarterly dividend, which has been increasing from $0.288 per share in 2000. Scana (SCG) currently trades at slightly above $40 and has a dividend yield of 4.68%