Yet even among the most elite tech stocks, the myth of a never-ending rise in the stock price really doesn’t hold up. Let’s forget the dot-com bubble of 2000 for a moment as we take a look at Microsoft, arguably one of the greatest technology success stories of the modern era. Shares of Microsoft peaked roughly five years ago and are unlikely to ever again deliver huge upside for investors.

Why such a glum view? The software giant’s sales grew just 5.4% in fiscal (June) 2012 to $73.7 billion, and are expected to keep growing at a mid-single digit pace in coming years. The surest sign of Microsoft’s senescence: Operating margins slipped below 30% in fiscal 2012 for the first time in eight years.

The next Microsoft?

For many years, the phrase “the next Microsoft” was always a proud moniker, signaling a newer, younger company’s ability to mimic Mister Softee’s meteoric growth spurt in its first 15 years as a public company. Perhaps no company lived up to this kind of hype as Google Inc (NASDAQ:GOOG).

Outside of Apple and Amazon, it’s hard to find such an impressive growth story. The company only reached the $1 billion revenue milestone in 2003, but had more than $10 billion in sales by 2006, $20 billion sales by 2008, on its way to more than $40 billion in sales this year, and a projected $53.7 billion sales in 2013, according to consensus forecasts.

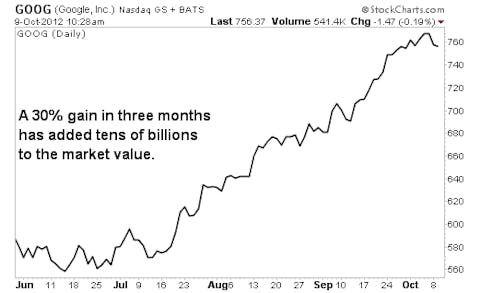

Investors have surely taken note: In recent months, Google’s stock has been scorching hot, giving it a $245 billion market value. It took quite a while, but Google Inc (NASDAQ:GOOG) is now worth as much as Microsoft. Might as well change the phrase to “the next Google.”

Counter-intuitively, this is the time to cash in your chips on this amazing tech stock. Cracks are emerging in the foundation and investors are set up for the same “dead money” phase they saw with Microsoft after it peaked at the end of 2007.

Here are four early warnings signs for Google Inc (NASDAQ:GOOG) that you should heed now:

1. Margins appear to have peaked

1. Margins appear to have peaked

It’s possible to see the true mark of a bright future in operating margins, as a company is able to generate sales growth faster than expense growth. Yet analysts now say that in the third quarter of the year, Google’s operating margins actually shrank a bit from a year ago. The full-year view shows an even starker contrast. Google’s EBITDA margins are on track to fall from 32.3% in 2011 to 27.2% in 2012, according to Citigroup. In effect, this is no longer a typical software-driven business model (which is usually characterized by high margins), but instead it’s becoming a labor and capital-intensive mature operating company.

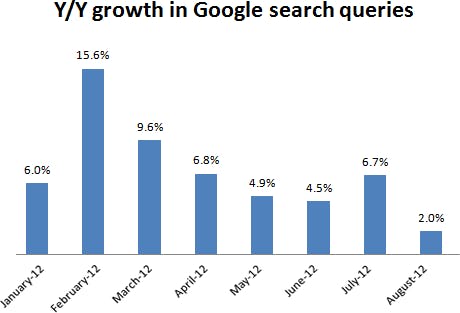

2. Peaking search

Though Google Inc (NASDAQ:GOOG) is pursuing a wide range of new initiatives, more than half of its cash flow still comes from the core search advertising business. But judging by recent trends, users are no longer conducting searches with rising frequency. The amount of searches on Google Inc (NASDAQ:GOOG) rose just 2% in August from a year ago, the lowest year-over-year growth rate in the company’s history. It seems as if search advertising has fully matured. It doesn’t help that Microsoft continues to challenge Google’s dominant market sharewith the Bing search engine, which launched in 2009. While mildly popular, consistent national TV advertising campaigns have made it Google’s biggest competitor in this category, ahead of the once-leading Yahoo! Inc. (NASDAQ:YHOO) search engine.

3. Lack of traction for new ideas

Give Google Inc (NASDAQ:GOOG) credit for trying many new business concepts. But be realistic that a number of these concepts simply aren’t showing any real traction. For example, Google has launched a Netflix, Inc. (NASDAQ:NFLX)-style streaming movies service, Google Play, yet it has barely made a dent in terms of market share. Google has only had moderate success with Google+: The service reportedly has 100 million monthly users, while Facebook Inc (NASDAQ:FB) now has more than one billion active users each month, according to founder Mark Zuckerberg. In terms of daily usage, Google+ appears unlikely to make a dent in Facebook’s social networking dominance.

Google Inc (NASDAQ:GOOG) has found, just as Microsoft did years ago, that branching out beyond the core profitable business is a big challenge. The company is surely having success with some of its initiatives, including the Android platform that’s used to power a majority of today’s smartphones and tablets. But another bonanza-like product or service appears unlikely.

4. The laws of bigness

Google is expected to boost sales by $13 billion in 2012, totaling $42.5 billion, and by another $11.5 billion in 2013. Yet even if the company kept adding that level of revenue each year, then it would represent a steady deceleration in terms of year-over-year growth as “the laws of bigness” kick in. For example, Google’s year-over-year sales are expected to rise 26% in 2013. But what lies ahead after that? Analysts at Citigroup anticipate sales growth of just 13% to $60.5 billion in 2014. Merrill Lynch anticipates a slightly better 13.5% growth rate. Goldman Sachs pegs 2014 growth at just 10%.

Even at that point, Google’s revenue base will still be smaller than Microsoft’s current $75 billion. And as noted earlier, Google Inc (NASDAQ:GOOG) is already now worth as much as Microsoft in terms of market value, so don’t confuse a surging stock price with surging growth.

Risks to Consider: As an upside risk for investors looking to short the stock, Google Inc (NASDAQ:GOOG) may look to deploy its $38 billion net cash position into acquisitions that can keep the top-line expanding at a rapid pace in 2014.

Action to Take –> This isn’t to suggest that shares of Google Inc (NASDAQ:GOOG) will take a big hit as growth slows. Instead, you need to know the history of Microsoft and many other great growth stocks that are long past their heady days of robust share price appreciation. The fact that shares of Google have risen 30% in just three months gives a false impression of more robust gains to come. These are the kinds of exit signs you should be looking for when harvesting winning investments.

This article was originally written by David Sterman, and posted on StreetAuthority.