Let’s review the top three mistaken reasons to sell AutoZone.

Slowing growth

Bear Argument: The recession forced many Americans to hold on to their vehicles longer, creating a boom for the auto parts retailers.

However,

Americans are beginning to replace their old vehicles, reducing demand for auto parts.

Recent financial result from AutoZone’s competitors suggests the industry still has lots of gas in the tank.

O’Reilly Automotive Inc (NASDAQ:ORLY) popped 10% earlier this month after it reported a spectacular fourth quarter. The company posted 7% and 20% revenue and EPS growth, respectively, beating Wall Street’s top and bottom line estimates. Same-store sales growth topped management guidance increasing 4.2% versus 3.3% during the previous year. Going forward, management sees comparable store sales growing 3%-5% in 2013.

I was also impressed with rival’s Advance Auto Parts, Inc. (NYSE:AAP) fourth-quarter results. The company reported a $0.88 EPS figure, easily beating Wall Street’s $0.76 estimate. Gross margins expanded 90 basis points to 49.9%. Management provided upbeat guidance projecting low single digit same-store sales growth next year.

These positive numbers hint that the auto parts bull run may not be slowing down as fast as the Street anticipates.

Market saturation

Bear Argument: AutoZone has exhausted its growth opportunities with almost 4,700 stores in operation throughout the U.S.

Yes, AutoZone has exhausted most of its retail expansion opportunities in the United States, but this growth story is far from over. The company has several additional growth drivers:

Commercial: AutoZone’s commercial division grossed $1.3 billion during fiscal 2012, up 20% from the previous year. Management plans to open a commercial department at most of their domestic locations. With only 65% of U.S. stores operating a commercial division, there’s lots of remaining expansion potential for this unit.

Mexico: Mexico represents a very attractive market for AutoZone. The country has an abundance of old cars, few organized chains and a shortage of quality parts. During 2012, AutoZone opened 42 new locations increasing its Mexican store count by 15%. Management has proven their business model works in the country and expects continued double digit growth.

Brazil: AutoZone opened their first location in Brazil last fall. Management is still testing this market before committing to further expansion but initial results appear promising. If successful, Brazil could represent a larger market than Mexico.

These growth drivers should allow AutoZone to sustain an EPS growth rate in the mid-teens over the next five years.

Expensive valuation

Bear Argument: AutoZone shares are up 250% over the past five years. The stock is priced for perfection at 12 times forward earnings.

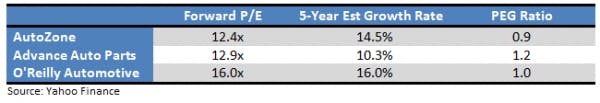

AutoZone is the cheapest name in the auto parts space with the stock sporting the lowest P/E multiple.

This markdown is deserved in some respects as AutoZone has a lower projected growth rate than rival O’Reilly.

However, AutoZone still trades at a discount when you value the stock on a PEG basis. With shares trading a 12.4 times forward earnings and a projected 14.5% EPS growth rates, the stock is valued at reasonable 0.9 PEG ratio.

Foolish bottom line

AutoZone reports its second-quarter earnings on Feb. 26. Given recent results from competitors, investors can expect a positive report. Keep a close eye on the company’s same-store sales figure for confirmation of domestic market improvement and additional commentary on AutoZone’s international expansion efforts.

The article 3 Mistaken Reasons to Sell AutoZone originally appeared on Fool.com and is written by Robert Baillieul.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.