As stock investors we are part owners in a company; this gives us certain political and economic rights in that business. Some companies stand out from the rest when it comes to capital allocation, permanently rewarding investors with dividend increases and share buybacks so that the owners receive a big chunk of the cash flows generated by the business. Three high quality companies showing you the money.

International Business Machines Corp. (NYSE:IBM) has implemented one the most amazing transformations in the history of corporate America when management decided it was time to move away from the commoditized hardware business and into more profitable areas like software and services back in the nineties. This has produced a spectacular increase in profit margins over the years and has been a big driver of earnings expansion for the company.

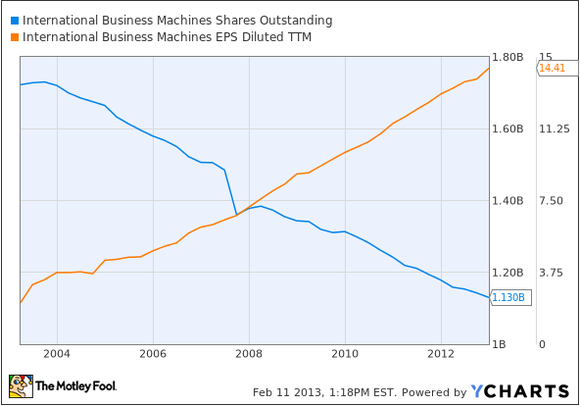

But it doesn´t end there, more profitability has also allowed IBM to heavily reward investors with a big share repurchase program in addition to growing dividends. Share count reduction has been another big plus for IBM investors over the years: when you own a piece of a company, and the company is sliced in fewer pieces, each piece increases its value as it has the right to a bigger proportion of the company´s earnings.

IBM pays a modest dividend yield of 1.7%, which doesn´t sound like anything to write home about. But when you consider share repurchases in addition to those dividends, Big Blue stands out like a very shareholder friendly corporation.

Energetic Dividends

The energy industry is quite cyclical, capital intensive, and always exposed to the volatility coming from fluctuating commodity prices. That´s why it’s not easy to find companies with steadily rising dividend payments and active stock buyback programs, but Exxon Mobil Corporation (NYSE:XOM) shines among its peers due to its superior profitability and capital allocation policies.

Being bigger that its peers, and quite conservative when it comes to competing for new exploration projects, Exxon won´t probably be the company which the highest growth rate in the industry, but it can certainly be considered the one with the highest quality. The company issued shares to finance the acquisition of XTO in 2010, but even in spite of that it has reduced its share count by more than 30% over the last 10 years.

Exxon has increased dividend payments each year for more than three decades, including all kind of scenarios when it comes to economic growth and energy demand. Exxon´s dividend yield of 2.6% is not the highest in the industry, but it can be considered the safest one.