The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of June 30. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Tristate Capital Holdings Inc (NASDAQ:TSC).

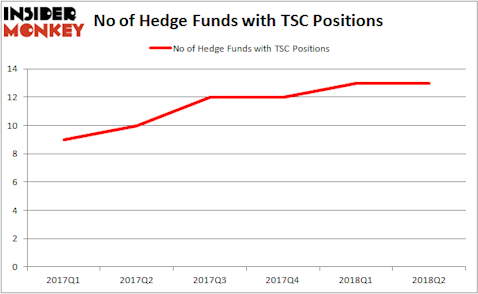

Tristate Capital Holdings Inc (NASDAQ:TSC) shares weren’t highly coveted during the second quarter by hedge funds. That’s somewhat surprising given those shares had gained 20% by the end of June, when just 13 of the hedge funds that we track were Tristate shareholders. Among those selling off the stock in Q2 was billionaire Glenn Russell Dubin of Highbridge Capital, who unloaded the 18,000 shares he had just bought in Q1. As of now, playing it cautious has proven wise, as Tristate shares have fallen in the second-half of 2018. Director James Dolan took advantage of the October slide to buy 6,000 shares, expressing his confidence in Tristate and landing the company on our countdown of The 25 Biggest Insider Purchases in October.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a glance at the new hedge fund action surrounding Tristate Capital Holdings Inc (NASDAQ:TSC).

How are hedge funds trading Tristate Capital Holdings Inc (NASDAQ:TSC)?

At Q3’s end, a total of 13 of the hedge funds tracked by Insider Monkey were long this stock, unchanged from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in TSC over the last 6 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among the funds that we track, Second Curve Capital held the most valuable stake in Tristate Capital Holdings Inc (NASDAQ:TSC), worth $26.5 million at the end of the second quarter. On the second spot was Royce & Associates, which has amassed $19.1 million worth of shares. Moreover, Castine Capital Management, ACK Asset Management, and Driehaus Capital were also bullish on Tristate Capital Holdings Inc (NASDAQ:TSC), allocating a large percentage of their portfolios to this stock.

Tristate Capital Holdings Inc (NASDAQ:TSC) has also faced some bearish sentiment from the smart money, as several hedgies slashed their entire stakes in the second quarter. As mentioned, Glenn Russell Dubin’s Highbridge Capital Management cut its stake, valued at $418,000. Dmitry Balyasny’s fund, Balyasny Asset Management, also dropped its $365,000 in stock. These moves are a valuable counterpoint to the bullishness, revealing there may be some areas of concern.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Tristate Capital Holdings Inc (NASDAQ:TSC) but similarly valued. These stocks are Green Plains Renewable Energy Inc. (NASDAQ:GPRE), Oritani Financial Corp. (NASDAQ:ORIT), Tidewater Inc. (NYSE:TDW), and Comtech Telecomm. Corp. (NASDAQ:CMTL). This group of stocks’ market valuations resemble TSC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GPRE | 12 | 154323 | -1 |

| ORIT | 11 | 44060 | 0 |

| TDW | 9 | 80494 | 0 |

| CMTL | 15 | 124927 | 0 |

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $101 million. That figure was $94 million in TSC’s case. Comtech Telecomm. Corp. (NASDAQ:CMTL) is the most popular stock in this table. On the other hand Tidewater Inc. (NYSE:TDW) is the least popular one with only 9 bullish hedge fund positions. Tristate Capital Holdings Inc (NASDAQ:TSC) is not the most popular stock in this group but hedge fund interest is still above average. Given there is also bullish insider buying activity, this stock could warrant a closer look.

Disclosure: None. This article was originally published at Insider Monkey.