Is ABB Ltd (ADR) (NYSE:ABB) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

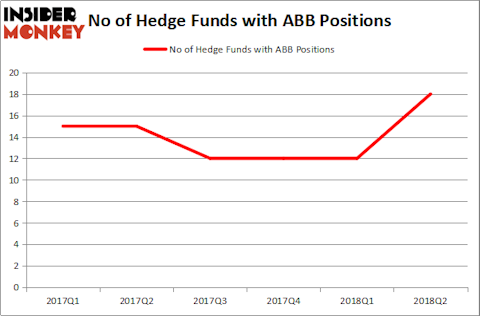

Hedge funds poured into ABB Ltd (ADR) (NYSE:ABB) in Q2, as the number of funds long the stock jumped by 50%. Despite the jump in shareholders, still just 0.6% of the company’s shares were owned by the hedge funds tracked in our database, making them very underweight the stock. ABB did rank 15th on our article: Billionaire Ken Fisher is Bullish About These Dividend Stocks. The stock’s dividend yield has been pushed above 4% after shares lost 15% in October.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

How have hedgies been trading ABB Ltd (ADR) (NYSE:ABB)?

At Q3’s end, a total of 18 of the hedge funds tracked by Insider Monkey were long this stock, a 50% surge from one quarter earlier. The graph below displays the number of hedge funds with bullish position in ABB over the last 6 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

More specifically, Ken Fisher’s Fisher Asset Management was the largest shareholder of ABB Ltd (ADR) (NYSE:ABB), with a stake worth $223.5 million reported as of the end of June. Trailing Fisher Asset Management was Renaissance Technologies, which amassed a stake valued at $17 million. 13D Management, Beddow Capital Management, and Bronson Point Partners were also very fond of the stock, giving the stock large weights in their portfolios.

As aggregate interest increased, key money managers have jumped into ABB Ltd (ADR) (NYSE:ABB) headfirst. Bronson Point Partners, managed by Larry Foley and Paul Farrell, assembled the most valuable position in ABB Ltd (ADR) (NYSE:ABB). Bronson Point Partners had $1.7 million invested in the company at the end of the quarter. Matthew Tewksbury’s Stevens Capital Management also initiated a $0.5 million position during the quarter. The other funds with new positions in the stock are Noam Gottesman’s GLG Partners, Dmitry Balyasny’s Balyasny Asset Management, and D E Shaw.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as ABB Ltd (ADR) (NYSE:ABB) but similarly valued. These stocks are Cognizant Technology Solutions Corp (NASDAQ:CTSH), Praxair, Inc. (NYSE:PX), Deere & Company (NYSE:DE), and Boston Scientific Corporation (NYSE:BSX). This group of stocks’ market values are similar to ABB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CTSH | 42 | 1992709 | -9 |

| PX | 45 | 1906532 | -7 |

| DE | 51 | 2635074 | 2 |

| BSX | 42 | 2091874 | 2 |

As you can see these stocks had an average of 45 hedge funds with bullish positions and the average amount invested in these stocks was $2.16 billion. That figure was $295 million in ABB’s case. Deere & Company (NYSE:DE) is the most popular stock in this table. On the other hand Cognizant Technology Solutions Corp (NASDAQ:CTSH) is the least popular one with only 42 bullish hedge fund positions. Compared to these stocks ABB Ltd (ADR) (NYSE:ABB) is even less popular than CTSH. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money doesn’t see much value in this stock right now.

Disclosure: None. This article was originally published at Insider Monkey.