After several tireless days we have finished crunching the numbers from the more than 700 13F filings issued by the elite hedge funds and other investment firms that we track at Insider Monkey, which disclosed those firms’ equity portfolios as of September 30. The results of that effort will be put on display in this article, as we share valuable insight into the smart money sentiment towards Brookdale Senior Living, Inc. (NYSE:BKD).

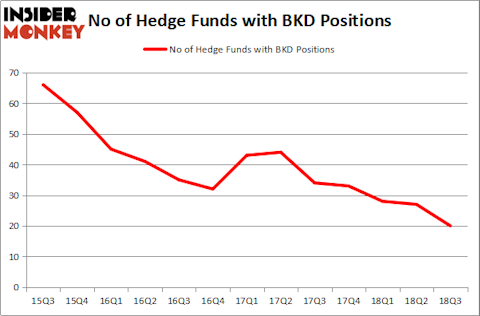

Brookdale Senior Living, Inc. (NYSE:BKD) investors should pay attention to a decrease in activity from the world’s largest hedge funds of late. BKD was in 20 hedge funds’ portfolios at the end of the third quarter of 2018. There were 27 hedge funds in our database with BKD positions at the end of the previous quarter. Our calculations also showed that BKD isn’t among the 30 most popular stocks among hedge funds.

According to most market participants, hedge funds are assumed to be worthless, outdated investment vehicles of years past. While there are over 8,000 funds trading at the moment, Our researchers hone in on the masters of this group, approximately 700 funds. Most estimates calculate that this group of people direct bulk of all hedge funds’ total capital, and by keeping track of their first-class picks, Insider Monkey has discovered various investment strategies that have historically outstripped the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to go over the latest hedge fund action regarding Brookdale Senior Living, Inc. (NYSE:BKD).

What have hedge funds been doing with Brookdale Senior Living, Inc. (NYSE:BKD)?

At the end of the third quarter, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -26% from the previous quarter. The graph below displays the number of hedge funds with bullish position in BKD over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Brookdale Senior Living, Inc. (NYSE:BKD) was held by Glenview Capital, which reported holding $102.9 million worth of stock at the end of September. It was followed by Camber Capital Management with a $63.9 million position. Other investors bullish on the company included Land & Buildings Investment Management, Paulson & Co, and Deerfield Management.

Because Brookdale Senior Living, Inc. (NYSE:BKD) has witnessed declining sentiment from the entirety of the hedge funds we track, we can see that there exists a select few hedge funds that decided to sell off their positions entirely in the third quarter. Intriguingly, Peter Muller’s PDT Partners dropped the largest position of the 700 funds monitored by Insider Monkey, comprising close to $6.8 million in stock. David Costen Haley’s fund, HBK Investments, also dropped its stock, about $3.9 million worth. These transactions are intriguing to say the least, as total hedge fund interest was cut by 7 funds in the third quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Brookdale Senior Living, Inc. (NYSE:BKD). We will take a look at Horace Mann Educators Corporation (NYSE:HMN), Vicor Corp (NASDAQ:VICR), Bloomin’ Brands Inc (NASDAQ:BLMN), and Guess’, Inc. (NYSE:GES). All of these stocks’ market caps are closest to BKD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HMN | 14 | 36254 | 2 |

| VICR | 16 | 73427 | 6 |

| BLMN | 26 | 372151 | 3 |

| GES | 17 | 81212 | -1 |

| Average | 18.25 | 140761 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.25 hedge funds with bullish positions and the average amount invested in these stocks was $141 million. That figure was $510 million in BKD’s case. Bloomin’ Brands Inc (NASDAQ:BLMN) is the most popular stock in this table. On the other hand Horace Mann Educators Corporation (NYSE:HMN) is the least popular one with only 14 bullish hedge fund positions. Brookdale Senior Living, Inc. (NYSE:BKD) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard BLMN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.