The month of September is one of the most significant in global markets all this year. August CPI numbers showed an increase of 0.1%, while the unemployment rate climbed month over month to 3.7%.

With these essential economic metrics now released, all eyes are on the hawkish United States Federal Reserve and if the central bank will hike rates by 100 bps or 75 bps. How aggressive the Fed gets will ultimately determine if a soft landing for the economy is possible or if the global economy could slide into a recession.

Risk is the highest it’s been in ages, which has resulted in an abundance of bearish sentiment, and extreme demand for options puts and in short interest. Typically, such one-sided conditions are the ideal setup for a squeeze and contrarian move, so there is risk at both ends of the trade.

Here is how you can protect risk with PrimeXBT.

Consumer Price Index Picks Back Up: Inflation Isn’t Transitory

The numbers coming in during September for August are running hot, and this makes September even more critical for the already devastating third quarter of 2022.

Global markets widely sold off into the dollar within moments of August CPI numbers being released. Year over year increases reached 8.3% in the Consumer Price Index, while month over month data grew by 0.1%. The month prior, inflation cooled off slightly, but the return to rising inflation made the phenomenon appear anything but transitory.

Within seconds of the CPI data being released, Bitcoin, the stock market, metals, and more all plunged due to unstoppable dollar strength. Because the Fed has been raising rates in an attempt to curb inflation, the market immediately priced in a 100 bps rate hike from the Fed.

Unsurprising Rise In Unemployment Rates: Ominous Recession Signal

There remains serious debate on whether or not there is a recession in the US. A shrinking GDP is only one crucial factor, while a decline in employment is yet another critical piece of the recessionary puzzle.

Unemployment has been primarily stable, even declining by 0.1% in July. This makes the 0.2% jump in August to 3.7% unemployment especially notable. Should September numbers continue to trend higher, markets could panic and further price in a recession.

Combined with September’s CPI data, the monthly close is crucial for markets to maintain support.

The Fed To Hike Rates Further: Forget About A Soft Landing

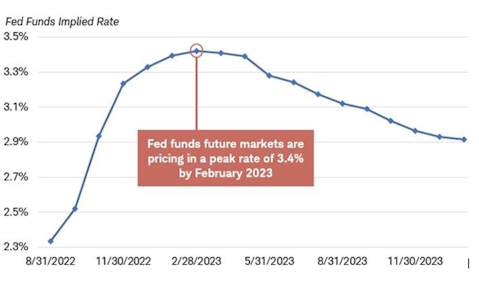

The Federal Reserve meets in September to decide if further measures are necessary to combat the highest inflation in over 40 years. Given the circumstances above, markets are anticipating a 100 bps rate hike.

The central bank is under pressure to simultaneously reduce inflation back to the target 2% rate while also doing the least damage to the integrity of markets possible — a so-called soft landing.

But markets are already on the ropes. The stock market is back in bear market territory, and cryptocurrencies have lost nearly 80% or more of their valuations across the board. The idea of a soft landing has essentially gone out the window, and it has investors and traders scrambling to protect against risk.

Practice Proper Risk Management: Using Professional PrimeXBT Tools

At the award-winning PrimeXBT, users can build a well-rounded and risk-averse portfolio using a variety of uncorrelated and anti-correlated assets. The margin trading platform offers long and short positions on stock indices, commodities, forex currencies, and crypto.

Crypto holders don’t have to sell their assets and can instead use them as collateral to trade digital and traditional assets on leverage. It is also possible to hedge spot positions by going short and protecting yourself against downside risk.

Proper risk management strategies, stop loss placement, and technical analysis can vastly improve the probability of successfully protecting capital and making wise investment decisions.

Why This Month Could Be Pivotal In Markets: A September To Remember

The remainder of 2022 is absolutely critical for the Federal Reserve, the economy, and global markets. Risk has never been higher, and it means you must be careful, strategic, or be left without any reward.

The month of September, in particular, could set the stage for the rest of the calendar year. If the final quarter in 2022 is once again bearish, the world might fall back into a recession for some time.

Play it extra safe this September with professional PrimeXBT risk management tools and the wide range of markets to choose from at the all-in-one solution.