Concerns over rising interest rates and expected further rate increases have hit several stocks hard since the end of the third quarter. NASDAQ and Russell 2000 indices are already in correction territory. More importantly, Russell 2000 ETF (IWM) underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points in the first half of the fourth quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were paring back their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Manhattan Associates, Inc. (NASDAQ:MANH).

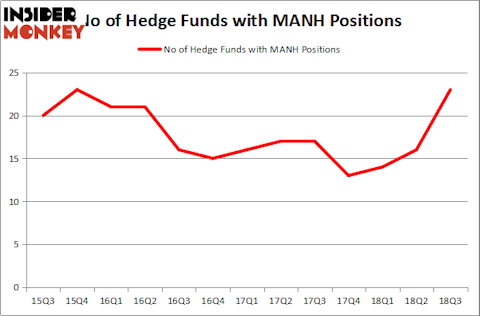

Manhattan Associates, Inc. (NASDAQ:MANH) was in 23 hedge funds’ portfolios at the end of the third quarter of 2018. MANH investors should be aware of an increase in enthusiasm from smart money of late. There were 16 hedge funds in our database with MANH holdings at the end of the previous quarter. Our calculations also showed that MANH isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s go over the fresh hedge fund action encompassing Manhattan Associates, Inc. (NASDAQ:MANH).

How are hedge funds trading Manhattan Associates, Inc. (NASDAQ:MANH)?

At the end of the third quarter, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 44% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in MANH over the last 13 quarters. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were adding to their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Robert G. Moses’s RGM Capital has the number one position in Manhattan Associates, Inc. (NASDAQ:MANH), worth close to $96 million, accounting for 7.6% of its total 13F portfolio. On RGM Capital’s heels is AQR Capital Management, led by Cliff Asness, holding a $41.9 million position; less than 0.1%% of its 13F portfolio is allocated to the company. Some other peers that are bullish contain Chuck Royce’s Royce & Associates, Noam Gottesman’s GLG Partners and Israel Englander’s Millennium Management.

As industrywide interest jumped, some big names were leading the bulls’ herd. Marshall Wace LLP, managed by Paul Marshall and Ian Wace, created the most valuable position in Manhattan Associates, Inc. (NASDAQ:MANH). Marshall Wace LLP had $4 million invested in the company at the end of the quarter. Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital also made a $3 million investment in the stock during the quarter. The other funds with brand new MANH positions are Dmitry Balyasny’s Balyasny Asset Management, Matthew Tewksbury’s Stevens Capital Management, and Steve Cohen’s Point72 Asset Management.

Let’s now take a look at hedge fund activity in other stocks similar to Manhattan Associates, Inc. (NASDAQ:MANH). These stocks are Platform Specialty Products Corporation (NYSE:PAH), MasTec, Inc. (NYSE:MTZ), Regal Beloit Corporation (NYSE:RBC), and Deckers Outdoor Corp (NYSE:DECK). All of these stocks’ market caps resemble MANH’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PAH | 24 | 1347697 | -3 |

| MTZ | 30 | 652548 | 8 |

| RBC | 17 | 114508 | 4 |

| DECK | 22 | 284198 | 2 |

| Average | 23.25 | 599738 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 23.25 hedge funds with bullish positions and the average amount invested in these stocks was $600 million. That figure was $271 million in MANH’s case. MasTec, Inc. (NYSE:MTZ) is the most popular stock in this table. On the other hand Regal Beloit Corporation (NYSE:RBC) is the least popular one with only 17 bullish hedge fund positions. Manhattan Associates, Inc. (NASDAQ:MANH) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MTZ might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.