The government requires hedge funds and wealthy investors with over a certain portfolio size to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30. We at Insider Monkey have made an extensive database of more than 700 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded CenturyLink, Inc. (NYSE:CTL) based on those filings.

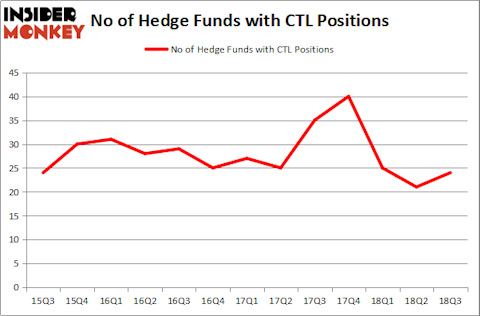

Is CenturyLink, Inc. (NYSE:CTL) a first-rate investment now? The best stock pickers are becoming more confident. The number of bullish hedge fund positions rose by 3 recently. Our calculations also showed that CTL isn’t among the 30 most popular stocks among hedge funds. CTL was in 24 hedge funds’ portfolios at the end of the third quarter of 2018. There were 21 hedge funds in our database with CTL positions at the end of the previous quarter.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

We’re going to take a look at the fresh hedge fund action surrounding CenturyLink, Inc. (NYSE:CTL).

What does the smart money think about CenturyLink, Inc. (NYSE:CTL)?

At Q3’s end, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 14% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CTL over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Mason Hawkins’s Southeastern Asset Management has the number one position in CenturyLink, Inc. (NYSE:CTL), worth close to $1.4445 billion, comprising 17.3% of its total 13F portfolio. On Southeastern Asset Management’s heels is Israel Englander of Millennium Management, with a $94.1 million position; 0.1% of its 13F portfolio is allocated to the stock. Remaining peers that hold long positions encompass Prem Watsa’s Fairfax Financial Holdings, Phill Gross and Robert Atchinson’s Adage Capital Management and Joel Greenblatt’s Gotham Asset Management.

As industrywide interest jumped, key hedge funds were breaking ground themselves. Gotham Asset Management, managed by Joel Greenblatt, initiated the most valuable position in CenturyLink, Inc. (NYSE:CTL). Gotham Asset Management had $19.5 million invested in the company at the end of the quarter. Lee Ainslie’s Maverick Capital also made a $7.1 million investment in the stock during the quarter. The other funds with brand new CTL positions are Matthew Hulsizer’s PEAK6 Capital Management, David Alexander Witkin’s Beryl Capital Management, and Guy Shahar’s DSAM Partners.

Let’s also examine hedge fund activity in other stocks similar to CenturyLink, Inc. (NYSE:CTL). These stocks are First Data Corporation (NYSE:FDC), Northern Trust Corporation (NASDAQ:NTRS), Atlassian Corporation Plc (NASDAQ:TEAM), and KKR & Co Inc. (NYSE:KKR). This group of stocks’ market valuations are closest to CTL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FDC | 61 | 3894803 | 12 |

| NTRS | 35 | 1039841 | 4 |

| TEAM | 28 | 1083076 | 7 |

| KKR | 31 | 2764720 | 7 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 38.75 hedge funds with bullish positions and the average amount invested in these stocks was $2196 million. That figure was $1712 million in CTL’s case. First Data Corporation (NYSE:FDC) is the most popular stock in this table. On the other hand Atlassian Corporation Plc (NASDAQ:TEAM) is the least popular one with only 28 bullish hedge fund positions. Compared to these stocks CenturyLink, Inc. (NYSE:CTL) is even less popular than TEAM. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.