Is 3M Company (NYSE:MMM) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments.

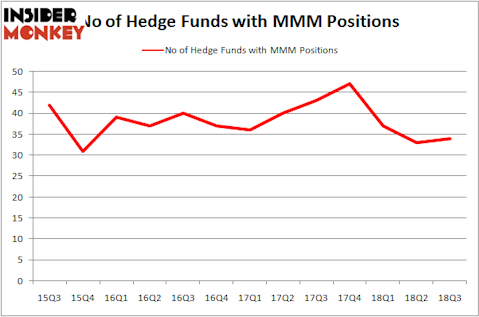

3M Company (NYSE:MMM) was in 34 hedge funds’ portfolios at the end of the third quarter of 2018. MMM has seen an increase in support from the world’s most elite money managers in recent months. There were 33 hedge funds in our database with MMM positions at the end of the previous quarter. Our calculations also showed that MMM isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s review the latest hedge fund action encompassing 3M Company (NYSE:MMM).

What does the smart money think about 3M Company (NYSE:MMM)?

At the end of the third quarter, a total of 34 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 3% from the second quarter of 2018. On the other hand, there were a total of 47 hedge funds with a bullish position in MMM at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Citadel Investment Group, managed by Ken Griffin, holds the largest position in 3M Company (NYSE:MMM). Citadel Investment Group has a $109 million call position in the stock, comprising less than 0.1%% of its 13F portfolio. On Citadel Investment Group’s heels is AQR Capital Management, managed by Cliff Asness, which holds a $78.6 million position; 0.1% of its 13F portfolio is allocated to the company. Other members of the smart money with similar optimism comprise Tom Gayner’s Markel Gayner Asset Management, Ian Simm’s Impax Asset Management and Phill Gross and Robert Atchinson’s Adage Capital Management.

As industrywide interest jumped, key hedge funds were leading the bulls’ herd. Osterweis Capital Management, managed by John Osterweis, created the most valuable position in 3M Company (NYSE:MMM). Osterweis Capital Management had $11.6 million invested in the company at the end of the quarter. Michael Platt and William Reeves’s BlueCrest Capital Mgmt. also initiated a $2 million position during the quarter. The other funds with new positions in the stock are Roger Ibbotson’s Zebra Capital Management, Ernest Chow and Jonathan Howe’s Sensato Capital Management, and Gregory Fraser, Rudolph Kluiber, and Timothy Krochuk’s GRT Capital Partners.

Let’s now take a look at hedge fund activity in other stocks similar to 3M Company (NYSE:MMM). These stocks are Honeywell International Inc. (NYSE:HON), China Petroleum & Chemical Corp (NYSE:SNP), Union Pacific Corporation (NYSE:UNP), and salesforce.com, inc. (NYSE:CRM). This group of stocks’ market values are similar to MMM’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HON | 47 | 2452575 | -2 |

| SNP | 13 | 284383 | -1 |

| UNP | 53 | 4921725 | 4 |

| CRM | 86 | 5615448 | 4 |

| Average | 49.75 | 3318533 | 1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 49.75 hedge funds with bullish positions and the average amount invested in these stocks was $3.32 billion. That figure was $356 million in MMM’s case. salesforce.com, inc. (NYSE:CRM) is the most popular stock in this table. On the other hand China Petroleum & Chemical Corp (NYSE:SNP) is the least popular one with only 13 bullish hedge fund positions. 3M Company (NYSE:MMM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CRM might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.