Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: International Flavors & Fragrances Inc (NYSE:IFF).

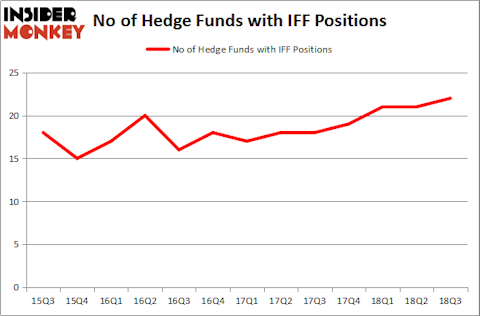

International Flavors & Fragrances Inc (NYSE:IFF) has experienced an increase in hedge fund interest of late. IFF was in 22 hedge funds’ portfolios at the end of September. There were 21 hedge funds in our database with IFF holdings at the end of the previous quarter. Our calculations also showed that IFF isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 6.3% year to date (through December 3rd) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 18 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the fresh hedge fund action surrounding International Flavors & Fragrances Inc (NYSE:IFF).

How are hedge funds trading International Flavors & Fragrances Inc (NYSE:IFF)?

Heading into the fourth quarter of 2018, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 5% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in IFF over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Citadel Investment Group, managed by Ken Griffin, holds the most valuable position in International Flavors & Fragrances Inc (NYSE:IFF). Citadel Investment Group has a $95.2 million position in the stock, comprising less than 0.1%% of its 13F portfolio. The second most bullish fund manager is GAMCO Investors, led by Mario Gabelli, holding a $82.2 million position; 0.6% of its 13F portfolio is allocated to the stock. Other peers that hold long positions contain Robert Joseph Caruso’s Select Equity Group, Israel Englander’s Millennium Management and Jim Simons’s Renaissance Technologies.

As one would reasonably expect, some big names have been driving this bullishness. Select Equity Group, managed by Robert Joseph Caruso, assembled the most outsized position in International Flavors & Fragrances Inc (NYSE:IFF). Select Equity Group had $44.2 million invested in the company at the end of the quarter. Jeffrey Talpins’s Element Capital Management also initiated a $14.1 million position during the quarter. The following funds were also among the new IFF investors: Anand Parekh’s Alyeska Investment Group, Howard Marks’s Oaktree Capital Management, and Steve Cohen’s Point72 Asset Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as International Flavors & Fragrances Inc (NYSE:IFF) but similarly valued. These stocks are Elanco Animal Health Incorporated (NYSE:ELAN), Norwegian Cruise Line Holdings Ltd (NYSE:NCLH), CF Industries Holdings, Inc. (NYSE:CF), and Marvell Technology Group Ltd. (NASDAQ:MRVL). This group of stocks’ market valuations are similar to IFF’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ELAN | 36 | 368441 | 36 |

| NCLH | 41 | 1012743 | 12 |

| CF | 33 | 1162426 | 3 |

| MRVL | 31 | 1899897 | -8 |

| Average | 35.25 | 1110877 | 10.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35.25 hedge funds with bullish positions and the average amount invested in these stocks was $1.11 billion. That figure was $412 million in IFF’s case. Norwegian Cruise Line Holdings Ltd (NYSE:NCLH) is the most popular stock in this table. On the other hand Marvell Technology Group Ltd. (NASDAQ:MRVL) is the least popular one with only 31 bullish hedge fund positions. Compared to these stocks International Flavors & Fragrances Inc (NYSE:IFF) is even less popular than MRVL. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.