The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of June 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards UnitedHealth Group Inc. (NYSE:UNH).

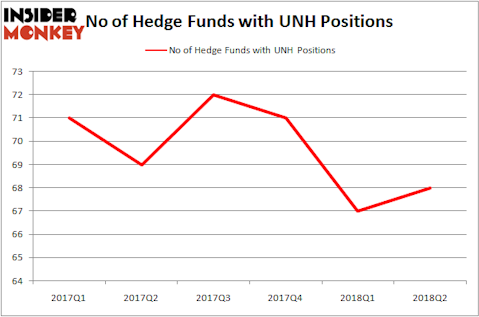

UnitedHealth Group Inc. (NYSE:UNH) has seen an increase in hedge fund interest in recent months. UNH was in 68 hedge funds’ portfolios at the end of June. There were 67 hedge funds in our database with UNH holdings at the end of the previous quarter. UNH was the 26th most popular stock among hedge funds at the end of the second quarter (see the list of 25 most popular stocks among hedge funds).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s review the latest hedge fund action encompassing UnitedHealth Group Inc. (NYSE:UNH).

Hedge fund activity in UnitedHealth Group Inc. (NYSE:UNH)

At the end of the third quarter, a total of 68 of the hedge funds tracked by Insider Monkey were long this stock, a change of 1% from the second quarter of 2018. On the other hand, there were a total of 69 hedge funds with a bullish position in UNH at the beginning of this year. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Eagle Capital Management, managed by Boykin Curry, holds the biggest position in UnitedHealth Group Inc. (NYSE:UNH). Eagle Capital Management has a $1.28 billion position in the stock, comprising 4.6% of its 13F portfolio. Sitting at the No. 2 spot is Lone Pine Capital, led by Stephen Mandel, holding a $1.01 billion position; 5.3% of its 13F portfolio is allocated to the company. Some other professional money managers that hold long positions comprise Gavin M. Abrams’s Abrams Bison Investments, Pasco Alfaro / Richard Tumure’s Miura Global Management and Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management.

As aggregate interest increased, some big names have been driving this bullishness. Navellier & Associates, managed by Louis Navellier, assembled the biggest position (in terms of portfolio weight) in UnitedHealth Group Inc. (NYSE:UNH). Navellier & Associates had $3.1 million invested in the company at the end of the quarter. Samuel Isaly’s OrbiMed Advisors also made a $30.3 million investment in the stock during the quarter. The following funds were also among the new UNH investors: Ian Cumming and Joseph Steinberg’s Leucadia National, George Soros’s Soros Fund Management, and Kenneth Tropin’s Graham Capital Management.

Let’s check out hedge fund activity in other stocks similar to UnitedHealth Group Inc. (NYSE:UNH). These stocks are AT&T Inc. (NYSE:T), Intel Corporation (NASDAQ:INTC), The Home Depot, Inc. (NYSE:HD), and Mastercard Inc (NYSE:MA). This group of stocks’ market values resemble UNH’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| T | 94 | 3043401 | 55 |

| INTC | 62 | 4570908 | 11 |

| HD | 52 | 4177989 | 3 |

| MA | 88 | 9345505 | 4 |

As you can see these stocks had an average of 74 hedge funds with bullish positions and the average amount invested in these stocks was $5284 million. That figure was $6526 million in UNH’s case. AT&T Inc. (NYSE:T) is the most popular stock in this table. On the other hand The Home Depot, Inc. (NYSE:HD) is the least popular one with only 52 bullish hedge fund positions. UnitedHealth Group Inc. (NYSE:UNH) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard T might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.