Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved, lost a third of its value since the end of July. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 30 S&P 500 stocks among hedge funds at the end of September 2018 yielded an average return of 6.7% year-to-date, vs. a gain of 2.6% for the S&P 500 Index. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of Shire PLC (NASDAQ:SHPG).

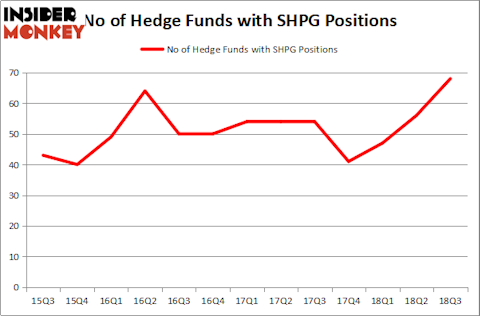

Is Shire PLC (NASDAQ:SHPG) a bargain? Hedge funds are becoming more confident. The number of bullish hedge fund bets inched up by 12 recently. Nonetheless, our calculations showed that SHPG isn’t among the 30 most popular stocks among hedge funds, though it fared better among billionaire investors, ranking 15th among the 30 Stocks Billionaires Are Crazy About: Insider Monkey Billionaire Stock Index.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to the beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Hedge fund activity in Shire PLC (NASDAQ:SHPG)

At Q3’s end, a total of 68 of the hedge funds tracked by Insider Monkey held long positions in this stock, a rise of 21% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SHPG over the last 13 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a few noteworthy hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

Among these funds, Adage Capital Management held the most valuable stake in Shire PLC (NASDAQ:SHPG), which was worth $580.1 million at the end of the third quarter. On the second spot was Glenview Capital which amassed $531.5 million worth of shares. Moreover, Paulson & Co, Abrams Capital Management, and Sachem Head Capital were also bullish on Shire PLC (NASDAQ:SHPG), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, specific money managers were breaking ground themselves. Abrams Capital Management, managed by David Abrams, assembled the most outsized position in Shire PLC (NASDAQ:SHPG). Abrams Capital Management had $407.3 million invested in the company at the end of the quarter. Dan Loeb’s Third Point also made a $290 million investment in the stock during the quarter. The following funds were also among the new SHPG investors: Daniel S. Och’s OZ Management, Isaac Corre’s Governors Lane, and Jeffrey Tannenbaum’s Fir Tree.

Let’s check out hedge fund activity in other stocks similar to Shire PLC (NASDAQ:SHPG). These stocks are Express Scripts Holding Company (NASDAQ:ESRX), The Estee Lauder Companies Inc (NYSE:EL), Boston Scientific Corporation (NYSE:BSX), and America Movil SAB de CV (NYSE:AMX). This group of stocks’ market valuations match SHPG’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ESRX | 68 | 6924037 | 17 |

| EL | 36 | 1464331 | 1 |

| BSX | 45 | 2420957 | 3 |

| AMX | 10 | 265643 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 40 hedge funds with bullish positions and the average amount invested in these stocks was $2.77 billion. That figure was $6.06 billion in SHPG’s case. Express Scripts Holding Company (NASDAQ:ESRX) is the most popular stock in this table. On the other hand America Movil SAB de CV (NYSE:AMX) is the least popular one with only 10 bullish hedge fund positions. Shire PLC (NASDAQ:SHPG) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ESRX might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.