Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. This time it may be different. During the first 6 weeks of the fourth quarter we observed increased volatility and small-cap stocks underperformed the market. Hedge fund investor letters indicated that they are cutting their overall exposure, closing out some position and doubling down on others. Let’s take a look at the hedge fund sentiment towards Anadarko Petroleum Corporation (NYSE:APC) to find out whether it was one of their high conviction long-term ideas.

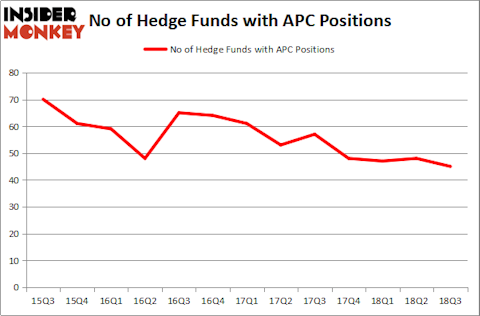

Anadarko Petroleum Corporation (NYSE:APC) investors should be aware of a decrease in hedge fund sentiment lately. Our calculations also showed that APC isn’t among the 30 most popular stocks among hedge funds.

To most investors, hedge funds are viewed as underperforming, old investment vehicles of years past. While there are greater than 8,000 funds with their doors open at the moment, Our researchers choose to focus on the aristocrats of this club, approximately 700 funds. Most estimates calculate that this group of people oversee most of the hedge fund industry’s total capital, and by shadowing their finest stock picks, Insider Monkey has spotted various investment strategies that have historically outrun Mr. Market. Insider Monkey’s flagship hedge fund strategy beat the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a peek at the fresh hedge fund action regarding Anadarko Petroleum Corporation (NYSE:APC).

Hedge fund activity in Anadarko Petroleum Corporation (NYSE:APC)

At Q3’s end, a total of 45 of the hedge funds tracked by Insider Monkey were long this stock, a change of -6% from the second quarter of 2018. On the other hand, there were a total of 48 hedge funds with a bullish position in APC at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Adage Capital Management held the most valuable stake in Anadarko Petroleum Corporation (NYSE:APC), which was worth $442.4 million at the end of the third quarter. On the second spot was D E Shaw which amassed $352.4 million worth of shares. Moreover, Citadel Investment Group, Eagle Capital Management, and Point72 Asset Management were also bullish on Anadarko Petroleum Corporation (NYSE:APC), allocating a large percentage of their portfolios to this stock.

Judging by the fact that Anadarko Petroleum Corporation (NYSE:APC) has witnessed bearish sentiment from hedge fund managers, it’s safe to say that there exists a select few money managers that elected to cut their entire stakes heading into Q3. It’s worth mentioning that John Labanowski’s Brenham Capital Management said goodbye to the biggest position of all the hedgies watched by Insider Monkey, valued at about $84.2 million in stock. Zach Schreiber’s fund, Point State Capital, also sold off its stock, about $63.3 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest fell by 3 funds heading into Q3.

Let’s also examine hedge fund activity in other stocks similar to Anadarko Petroleum Corporation (NYSE:APC). These stocks are Equinix, Inc. (REIT) (NASDAQ:EQIX), Analog Devices, Inc. (NASDAQ:ADI), Fiat Chrysler Automobiles NV (NYSE:FCAU), and The Allstate Corporation (NYSE:ALL). This group of stocks’ market valuations match APC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EQIX | 41 | 2263056 | 4 |

| ADI | 28 | 2930807 | -2 |

| FCAU | 33 | 2254365 | 4 |

| ALL | 34 | 2104113 | 2 |

| Average | 34 | 2388 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34 hedge funds with bullish positions and the average amount invested in these stocks was $2.39 billion. That figure was $2.1 billion in APC’s case. Equinix, Inc. (REIT) (NASDAQ:EQIX) is the most popular stock in this table. On the other hand Analog Devices, Inc. (NASDAQ:ADI) is the least popular one with only 28 bullish hedge fund positions. Compared to these stocks Anadarko Petroleum Corporation (NYSE:APC) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.