You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

Ameren Corporation (NYSE:AEE) investors should pay attention to an increase in hedge fund interest in recent months. Our calculations also showed that aee isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a look at the fresh hedge fund action encompassing Ameren Corporation (NYSE:AEE).

How are hedge funds trading Ameren Corporation (NYSE:AEE)?

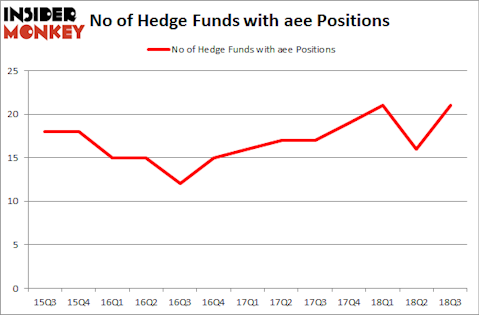

Heading into the fourth quarter of 2018, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a change of 31% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards AEE over the last 13 quarters. With hedge funds’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

Among these funds, Renaissance Technologies held the most valuable stake in Ameren Corporation (NYSE:AEE), which was worth $293.5 million at the end of the third quarter. On the second spot was AQR Capital Management which amassed $277.8 million worth of shares. Moreover, Adage Capital Management, Two Sigma Advisors, and Blackstart Capital were also bullish on Ameren Corporation (NYSE:AEE), allocating a large percentage of their portfolios to this stock.

As one would reasonably expect, some big names were leading the bulls’ herd. Shelter Harbor Advisors, managed by Peter J. Hark, established the biggest position in Ameren Corporation (NYSE:AEE). Shelter Harbor Advisors had $7.9 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also made a $1.9 million investment in the stock during the quarter. The other funds with brand new AEE positions are Charles Davidson and Joseph Jacobs’s Wexford Capital, Michael Platt and William Reeves’s BlueCrest Capital Mgmt., and Paul Tudor Jones’s Tudor Investment Corp.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Ameren Corporation (NYSE:AEE) but similarly valued. We will take a look at Celanese Corporation (NYSE:CE), Mercadolibre Inc (NASDAQ:MELI), Lennar Corporation (NYSE:LEN), and Broadridge Financial Solutions, Inc. (NYSE:BR). This group of stocks’ market valuations are similar to AEE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CE | 32 | 1332134 | -1 |

| MELI | 27 | 1977651 | -2 |

| LEN | 66 | 2818386 | 3 |

| BR | 33 | 536012 | 10 |

| Average | 39.5 | 1666046 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 39.5 hedge funds with bullish positions and the average amount invested in these stocks was $1.67 billion. That figure was $684 million in AEE’s case. Lennar Corporation (NYSE:LEN) is the most popular stock in this table. On the other hand Mercadolibre Inc (NASDAQ:MELI) is the least popular one with only 27 bullish hedge fund positions. Compared to these stocks Ameren Corporation (NYSE:AEE) is even less popular than MELI. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.