According to a filing with the SEC, James Robo purchased 4,500 shares of J.B. Hunt Transport Services, Inc. (NASDAQ:JBHT) on October 31st at an average price of $57.49. Robo, who became the new CEO of Nextera Energy earlier this year, serves on J.B. Hunt’s Board of Directors and so this transaction had to be disclosed as an insider buy. Insiders who purchase shares of their company’s stock are forgoing diversification- it’s generally rational to diversify one’s wealth away from being too concentrated in a small number of companies- and so when they do this it is theoretically because they are extremely confident in the company’s prospects. Read our review of studies on insider purchases. Robo now owns about 63,000 shares of the trucking company. Our database of insider filings shows that he bought shares in August 2011 at an average price of $42.41 per share- note the 36% increase in the stock price in the last 15 months, while the S&P 500 index has returned about 10%. Research Robo’s insider purchases and sales.

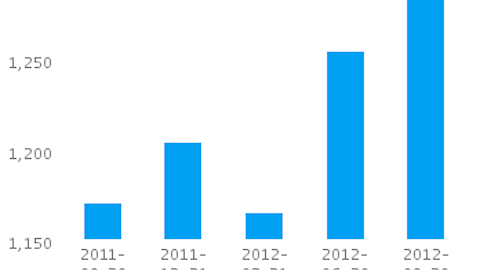

In the third quarter of 2012, J.B. Hunt’s revenues were up 11% from the same period in 2011. The growth rates were about the same for the company’s core business and for its fuel surcharges. Operating expenses were higher, led by bigger bills for rents and purchased transportation, but margins expanded to the point where earnings were up 14%. This was a slowdown from the pace that J.B. Hunt Transport Services, Inc. grew in the first half of the year- in total, net income for the first nine months of 2012 was up 23% versus a year ago- but still represents impressive performance.

At a market capitalization of $6.9 billion, it is apparent that the market expects considerably more growth from the company: its current trailing P/E is 23, which is higher than where we’d generally consider recommending a stock. It even trades at 20 times consensus estimates for next year’s earnings, and so our impression is that investors shouldn’t be imitating this insider purchase. Jeffrey Vinik’s Vinik Asset Management reduced its stake in J.B. Hunt Transport Services, Inc. over the course of the second quarter, but still owned about 280,000 shares at the end of June (find more stocks owned by Vinik Asset Management).

Peers in the trucking industry include Old Dominion Freight Line (NASDAQ:ODFL), Landstar System, Inc. (NASDAQ:LSTR), Werner Enterprises, Inc. (NASDAQ:WERN), and Con Way Inc (NYSE:CNW). These four companies are all smaller than J.B. Hunt in terms of market cap, being clustered between equity valuations of $1.5 billion and $3 billion. Possibly because their businesses generate less profit, their earnings multiples place them at a discount to the larger trucker: the trailing P/Es are between 14 and 18, making J.B. Hunt a substantial outlier on that basis. It’s possible that whether because of its size or some other industry factor that company does have better growth opportunities, and there is the insider purchase to consider, but we’d generally prefer to invest in a cheaper alternative.

At Werner and Con Way, little change in revenue last quarter compared to the third quarter of last year led to a double-digit percentage decline in earnings. Landstar and Old Dominion each grew both of these numbers. Con Way is the lowest-priced of these five companies, on both a trailing and a forward basis, but we think that investors can get a stock in a more consistent business at only a slightly higher multiple that still looks good relative to J.B. Hunt.

Investors who are interested in the trucking industry probably shouldn’t pay too much attention to Robo’s move. J.B. Hunt is considerably more expensive on an earnings basis than its peers, and even taking the company’s historical growth rate into account it still looks overvalued.