Alexander Medina Seaver‘s Stadium Capital Management has disclosed, in a filing with the SEC, a letter sent to the shareholders of Insperity Inc (NYSE:NSP). In the letter the investor discussed the possible reasons why Insperity is trading at a discount and suggest several steps that could increase the value of the company for its shareholders. Stadium has recently upped its position in the company to around 2.32 million shares, which represent 9.1% of the outstanding stock.

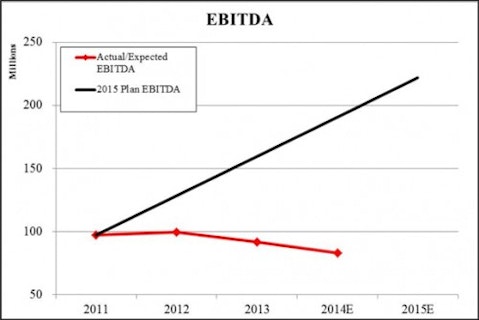

Stadium considers that Insperity Inc (NYSE:NSP) is undervalued because it delivers weak operating results. The company has underperformed in comparison with its long- and short-term operating goals and in comparison with its peer group index. The graph below shows this underperformance in terms of EBITDA:

Moreover, the fund considers that the management of the company has been overpaid on the back on delivering poor results.

“Despite this period of stagnant EBITDA and dismal shareholder value creation, Insperity’s CEO has received nearly $18 million in total compensation over the last six years, while Insperity’s named executive officers (“NEOs”) have collectively received nearly $53 million over the same time period6. As we highlighted earlier, Insperity’s forecasted EBITDA for FY 2014 is tracking approximately 50% below the rate articulated in the five-year plan released by management in 2011 (also attached in this filing), yet the total compensation for both the CEO and the company’s NEOs has remained consistently high. Short-term cash bonuses have typically been too easy to achieve, Insperity’s long-term equity incentives lack any form of performance-based vesting, and the board has shown no inclination to reduce management’s lavish perquisites,” the fund said.

Overall, the increase of shareholder value of Insperity Inc (NYSE:NSP) has been weak in terms of shareholder value, in comparison with the peer companies and market indexes.

“We strongly believe that this is the result of the Company’s disappointing and poor operating underperformance combined with the market’s perception that Insperity’s flawed governance structure will prevent the Company from (a) achieving better results, (b) making the changes required if results are not improved and (c) realizing value to shareholders through a sale of the Company.”

In order to fix the aforementioned issues, Stadium proposed several measures, such as enacting governance changes, which involve splitting the role of CEO and Chairman, de-classifying the board and appointing three directors nominated by Stadium, with one to become the chairman of the board. The fund has asked for three seats on Insperity Inc (NYSE:NSP)’s board previously, but the board declined the request and offered only one place. The investor considers also that the company should use the excess of capital it holds to repurchase its stock.

Insperity Inc (NYSE:NSP) also should consider exploring strategic alternatives, engaging new financial advisors and create a special committee for this purpose.

“In our opinion, it is time for immediate change at Insperity. The board needs to address stagnant operating results as well as the corporate governance practices that have permitted excessive compensation and the squandering of shareholder resources. The board must also explore strategic alternatives for the Company immediately. We also look forward to Insperity’s receiving any additional overtures from potential private equity or strategic acquirers, as we think there is significant potential value to be unlocked at Insperity that is well in excess of today’s current market valuation,” the fund concluded.

The full text of the letter can be accessed through the link below:

Stadium Capital Letter to Insperity Shareholders

Disclosure: none

Recommended Reading:

Top Recent Hedge Funds’ Moves Worth Keeping Track of

Orange Capital Boosts Stake in Pinnacle Entertainment, Inc (PNK) and Proposes a Real Estate Spin-Off

Cerberus Capital Reports Holding Over 8% of Ally Financial Inc (ALLY)