Tybourne Capital Management is a fund managed by Eashwar Krishnan, which has an equity portfolio worth over $2.00 billion as of the end of September compared to $1.93 billion a quarter earlier. The fund invests mainly in consumer and technology stocks and last quarter, it returns 13.01% from nine long positions in companies worth at least $1.0 billion, according to our calculations. In this article, we’ll take a look at some of the fund’s stock picks, including Chipotle Mexican Grill, Inc. (NYSE:CMG), Workday Inc (NYSE:WDAY), Boston Beer Co Inc (NYSE:SAM). In addition, we’ll take a look at Dunkin Brands Group Inc (NASDAQ:DNKN), in which the fund unloaded its stake in the third quarter.

Hedge funds on average underperform the market in bull markets because they are hedged. In our rankings, we consider only their long non-microcap positions. This way when we can compare these returns to the returns of the S&P 500 ETFs, which are basically 100% long portfolios of large-cap stocks.

Most of the hedge funds are hedged. This means they make 8% on the long side of their portfolio but they lose money on the short side of their portfolio. Their net returns also shrink after taking into account their cash or debt positions that don’t usually return much in this environment. Net of hedging and fees, it isn’t surprising to see that hedge fund investors experience lower returns than index fund investors. If investors don’t want the downside protection that comes with investing in hedge funds and want to beat the market returns, they can consider investing in the individual stock picks successful hedge fund managers.

Tybourne Capital Management cut its stake in Chipotle Mexican Grill, Inc. (NYSE:CMG) by 16% in the third quarter, ending the period with a total of 498,219 shares worth $210.99 million. The stock returned 5.1% during the third quarter. Among the funds we track, 39 funds held shares of Chipotle Mexican Grill, Inc. (NYSE:CMG) at the end of June, unchanged over the quarter. Among them, Tyborne held the largest stake at the end of June, followed by Generation Investment Management, which had a stake valued at $230.9 million. Citadel Investment Group, Steadfast Capital Management, and Point72 Asset Management also held valuable positions in the company.

Follow Chipotle Mexican Grill Inc (NYSE:CMG)

Follow Chipotle Mexican Grill Inc (NYSE:CMG)

Tybourne Capital Management trimmed its stake in Workday Inc (NYSE:WDAY) by 12% in the third quarter as it reported ownership of 2.39 million shares of the company worth $219.97 million in its latest 13F filing. The stake was reduced as the stock advanced by 22.8% between July and September. Heading into the third quarter of 2016, a total of 25 funds tracked by Insider Monkey held long positions in this stock, unchanged over the quarter. Matrix Capital Management was the largest shareholder of Workday Inc (NYSE:WDAY), with a stake worth $381.6 millions reported as of the end of June. Criterion Capital, Citadel Investment Group, and SRS Investment Management also held valuable positions in the company.

Follow Workday Inc. (NYSE:WDAY)

Follow Workday Inc. (NYSE:WDAY)

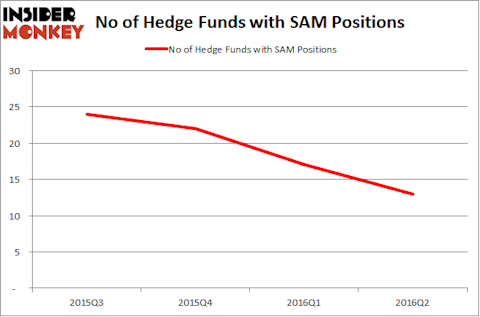

Tybourne Capital Management had 911,613 shares of Boston Beer Co Inc (NYSE:SAM), which were valued at $141.54 million. As the stake was basically unchanged during the third quarter, amid a 9.2% drop registered by the stock, the value of the holding slid from $156.02 million it had at the end of June. Boston Beer Co Inc (NYSE:SAM) was included in the equity portfolios of 13 funds tracked by us at the end of June, down from 17 funds a quarter earlier. Tybourne Capital was also the largest shareholder among these funds and was followed by Fisher Asset Management with a $59 million position. Other investors bullish on the company at the end of June included Manikay Partners, AQR Capital Management, and Two Sigma Advisors.

Follow Boston Beer Co Inc (NYSE:SAM)

Follow Boston Beer Co Inc (NYSE:SAM)

As Dunkin Brands Group Inc (NASDAQ:DNKN)’s stock advanced by 20.2% in the third quarter, Tybourne Capital Management sold its entire position in the company, unloading over 1.54 million shares it had held at the end of June. At the end of June, 21 funds from our database were long this stock, up by 17% over the quarter. Trailing Tybourne Capital Management (which was the largest shareholder) was Citadel Investment Group, which amassed a stake valued at $56.1 million at the end of the second quarter. Two Sigma Advisors, Suvretta Capital Management, and Tremblant Capital also held valuable positions in the company.

Follow Dunkin' Brands Group Inc. (NASDAQ:DNKN)

Follow Dunkin' Brands Group Inc. (NASDAQ:DNKN)

Disclosure: none