The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards SunOpta, Inc. (USA) (NASDAQ:STKL) .

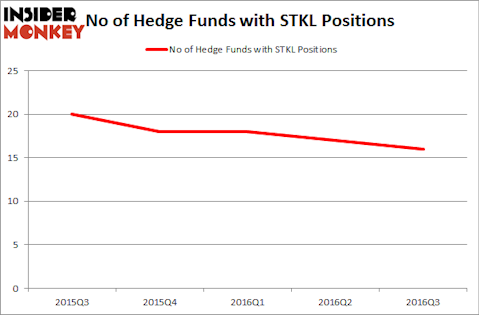

Is SunOpta, Inc. (USA) (NASDAQ:STKL) the right investment to pursue these days? Prominent investors are actually taking a bearish view. The number of long hedge fund bets that are revealed through the 13F filings retreated by 1 lately. STKLwas in 16 hedge funds’ portfolios at the end of September. There were 17 hedge funds in our database with STKL positions at the end of the previous quarter. At the end of this article we will also compare STKL to other stocks including Blackrock Kelso Capital Corp. (NASDAQ:BKCC), CVR Partners LP (NYSE:UAN), and FARO Technologies, Inc. (NASDAQ:FARO) to get a better sense of its popularity.

Follow Sunopta Inc. (NASDAQ:STKL)

Follow Sunopta Inc. (NASDAQ:STKL)

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Fotokostic/Shutterstock.com

Now, we’re going to take a look at the recent action encompassing SunOpta, Inc. (USA) (NASDAQ:STKL).

What does the smart money think about SunOpta, Inc. (USA) (NASDAQ:STKL)?

At Q3’s end, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -6% from one quarter earlier. On the other hand, there were a total of 18 hedge funds with a bullish position in STKL at the beginning of this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were boosting their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Tourbillon Capital Partners, led by Jason Karp, holds the number one position in SunOpta, Inc. (USA) (NASDAQ:STKL). Tourbillon Capital Partners has a $59.7 million position in the stock, comprising 1.2% of its 13F portfolio. Sitting at the No. 2 spot is Glenn W. Welling of Engaged Capital, with a $45.4 million position; the fund has 16.5% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions include Greg Boland’s West Face Capital, Philip Hempleman’s Ardsley Partners and Anand Parekh’s Alyeska Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.