Does Baidu.com, Inc. (ADR) (NASDAQ:BIDU) represent a good buying opportunity at the moment? Let’s briefly check the hedge fund sentiment towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail unconceivably on some occasions, but their stock picks have been generating superior risk-adjusted returns on average over the years.

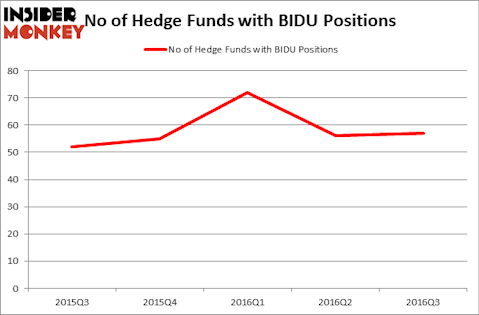

Baidu.com, Inc. (ADR) (NASDAQ:BIDU) was included in the equity portfolios of 57 investors tracked by us at the end of September. BIDU investors should pay attention to an increase in enthusiasm from smart money, as there had been 56 funds in our database with BIDU positions at the end of the previous quarter. At the end of this article we will also compare BIDU to other stocks, including Monsanto Company (NYSE:MON), Stryker Corporation (NYSE:SYK), and Public Storage (NYSE:PSA) to get a better sense of its popularity.

Follow Baidu Inc (NASDAQ:BIDU)

Follow Baidu Inc (NASDAQ:BIDU)

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

wrangler/Shutterstock.com

Now, we’re going to review the recent action surrounding Baidu.com, Inc. (ADR) (NASDAQ:BIDU).

How are hedge funds trading Baidu.com, Inc. (ADR) (NASDAQ:BIDU)?

A total of 57 hedge funds tracked by Insider Monkey held shares of Baidu at the end of September, up by 2% from the second quarter of 2016. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Cantillon Capital Management, led by William von Mueffling, holds the largest position in Baidu.com, Inc. (ADR) (NASDAQ:BIDU). Cantillon Capital Management has a $376.8 million position in the stock, comprising 5.3% of its 13F portfolio. Sitting at the No. 2 spot is Matt Sirovich and Jeremy Mindich’s Scopia Capital holding a $354.6 million position; 6.3% of its 13F portfolio is allocated to the company. Some other hedge funds and institutional investors that are bullish encompass Kerr Neilson’s Platinum Asset Management and Jonathan Auerbach’s Hound Partners.