Hedge funds may not always be right, even collectively, but data shows that their consensus long positions have historically outperformed broader market benchmarks. For example, the Goldman Sachs’ VIP list, which includes the 50 stocks that appear the most often among hedge funds’ top-10 largest holdings, has beaten the S&P 500 gauge on a quarterly basis 64% of the time since 2001, including last year, when it delivered impressive 23% returns in a flat market. Meanwhile, Goldman Sachs’ list of the 20 ‘Most Concentrated’ stocks, which hedge funds own the highest percentage of in terms of the stock’s float, has gained 18% this year to the S&P 500’s 8% gains. Clearly, it’s worthwhile to pay attention to what hedge funds are buying, so let’s check out the latest 13F filing data to see what they think about Assurant, Inc. (NYSE:AIZ).

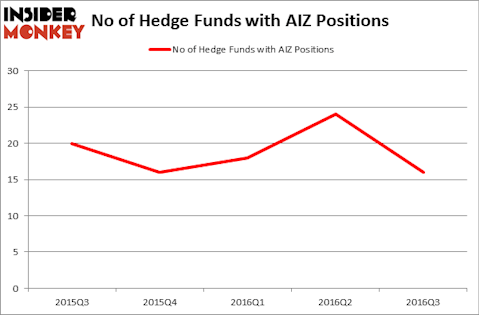

During the third quarter, the number of bullish hedge fund positions in Assurant, Inc. (NYSE:AIZ) declined by eight. The company was included in the portfolios of 16 funds tracked by Insider Monkey at the end of September, down from 24 funds a quarter earlier. At the end of this article we will also compare AIZ to other stocks including JetBlue Airways Corporation (NASDAQ:JBLU), Post Holdings Inc (NYSE:POST), and Calpine Corporation (NYSE:CPN) to get a better sense of its popularity.

Follow Assurant Inc. (NYSE:AIZ)

Follow Assurant Inc. (NYSE:AIZ)

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Ravital/Shutterstock.com

What does the smart money think about Assurant, Inc. (NYSE:AIZ)?

At the end of third quarter, 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, which represents a drop of 33% from the second quarter of 2016. By comparison, 16 hedge funds held shares or bullish call options in AIZ heading into 2016. With hedgies’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Cliff Asness’ AQR Capital Management holds the largest position in Assurant, Inc. (NYSE:AIZ). AQR Capital Management has a $160.4 million position in the stock. The second largest stake is held by Jim Simons’ Renaissance Technologies, which disclosed a $20 million position. Other professional money managers that are bullish comprise Phill Gross and Robert Atchinson’s Adage Capital Management, David Harding’s Winton Capital Management and Richard S. Pzena’s Pzena Investment Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.