Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

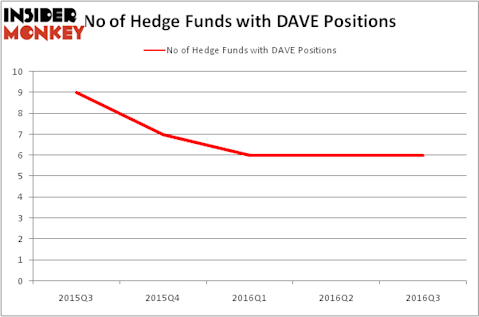

Famous Dave’s of America, Inc. (NASDAQ:DAVE) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 6 hedge funds’ portfolios at the end of September, same as at the end of June. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as The Bon-Ton Stores, Inc. (NASDAQ:BONT), Orion Energy Systems, Inc. (NYSEAMEX:OESX), and Streamline Health Solutions Inc. (NASDAQ:STRM) to gather more data points.

Follow Bbq Holdings Inc. (NASDAQ:BBQ)

Follow Bbq Holdings Inc. (NASDAQ:BBQ)

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

How have hedgies been trading Famous Dave’s of America, Inc. (NASDAQ:DAVE)?

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from the second quarter of 2016. By comparison, 7 hedge funds held shares or bullish call options in DAVE heading into this year, so hedge fund sentiment has slipped slightly in 2016. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Charles Davidson’s Wexford Capital has the most valuable position in Famous Dave’s of America, Inc. (NASDAQ:DAVE), worth close to $7.3 million, amounting to 1.2% of its total 13F portfolio. On Wexford Capital’s heels is Bandera Partners, led by Gregory Bylinsky and Jefferson Gramm, which holds a $4.6 million position; the fund has 3% of its 13F portfolio invested in the stock. Remaining hedge funds and institutional investors that hold long positions encompass Jonathan Lennon’s Pleasant Lake Partners, Adam Wright and Gary Kohler’s Blue Clay Capital, and Renaissance Technologies, one of the largest hedge funds in the world. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.