We started seeing tectonic shifts in the market during the third quarter. Small-cap stocks underperformed the large-cap stocks by more than 10 percentage points between the end of June 2015 and the end of June 2016. A mean reversion in trends bumped small-cap stocks’ return to almost 9% in Q3, outperforming their large-cap peers by 5 percentage points. The momentum in small-cap space hasn’t subsided during this quarter either. Small-cap stocks beat large-cap stocks by another 5 percentage points during the first 7 weeks of this quarter. Hedge funds and institutional investors tracked by Insider Monkey usually invest a disproportionate amount of their portfolios in smaller cap stocks. We have been receiving indications that hedge funds were boosting their overall exposure and this is one of the factors behind the recent movements in major indices. In this article, we will take a closer look at hedge fund sentiment towards Mohawk Industries, Inc. (NYSE:MHK).

Is Mohawk Industries, Inc. (NYSE:MHK) a cheap investment today? The best stock pickers seem to be becoming hopeful, since the number of long hedge fund bets has improved by two lately. At the end of this article we will also compare MHK to other stocks, including TransDigm Group Incorporated (NYSE:TDG), Freeport-McMoRan Copper & Gold Inc. (NYSE:FCX), and Check Point Software Technologies Ltd. (NASDAQ:CHKP) to get a better sense of its popularity.

Follow Mohawk Industries Inc (NYSE:MHK)

Follow Mohawk Industries Inc (NYSE:MHK)

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Syda Productions/Shutterstock.com

With all of this in mind, let’s take a look at the recent action surrounding Mohawk Industries, Inc. (NYSE:MHK).

How have hedgies been trading Mohawk Industries, Inc. (NYSE:MHK)?

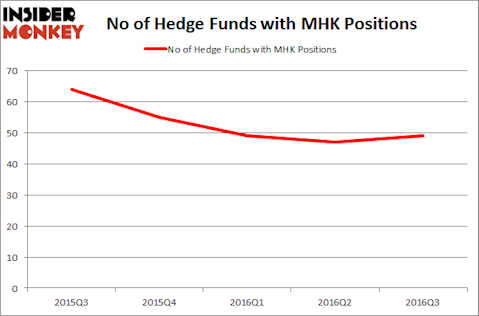

At the end of the third quarter, a total of 49 funds tracked by Insider Monkey were bullish on Mohawk Industries, which represents an increase of 4% over the quarter. With hedge funds’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Robert Joseph Caruso’s Select Equity Group has the biggest position in Mohawk Industries, Inc. (NYSE:MHK), worth close to $457.4 million, corresponding to 4% of its total 13F portfolio. The second most bullish fund manager is Lone Pine Capital, managed by Stephen Mandel, which holds a $235.8 million position; the fund has 1.1% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism comprise John Armitage’s Egerton Capital Limited, Ken Griffin’s Citadel Investment Group, and Dan Loeb’s Third Point.