Looking for high-potential stocks? Just follow the big players within the hedge fund industry. Why should you do so? Let’s take a brief look at what statistics have to say about hedge funds’ stock picking abilities to illustrate. The Standard and Poor’s 500 Index returned approximately 7.6% in the 12 months ending November 21, with more than 51% of the stocks in the index failing to beat the benchmark. Therefore, the odds that one will pin down a winner by randomly picking a stock are less than the odds in a fair coin-tossing game. Conversely, best performing hedge funds’ 30 preferred mid-cap stocks generated a return of 18% during the same 12-month period. Coincidence? It might happen to be so, but it is unlikely. Our research covering a 17-year period indicates that hedge funds’ stock picks generate superior risk-adjusted returns. That’s why we believe it is wise to check hedge fund activity before you invest your time or your savings on a stock like ENSCO PLC (NYSE:ESV).

ENSCO PLC (NYSE:ESV) investors should pay attention to an increase in hedge fund interest in recent months. At the end of this article we will also compare ESV to other stocks including National Beverage Corp. (NASDAQ:FIZZ), Prestige Brands Holdings, Inc. (NYSE:PBH), and Metals USA Holdings Corp (NYSE:MUSA) to get a better sense of its popularity.

Follow Valaris Ltd (NYSE:VAL)

Follow Valaris Ltd (NYSE:VAL)

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

ded pixto/Shutterstock.com

Keeping this in mind, let’s go over the recent action surrounding ENSCO PLC (NYSE:ESV).

What have hedge funds been doing with ENSCO PLC (NYSE:ESV)?

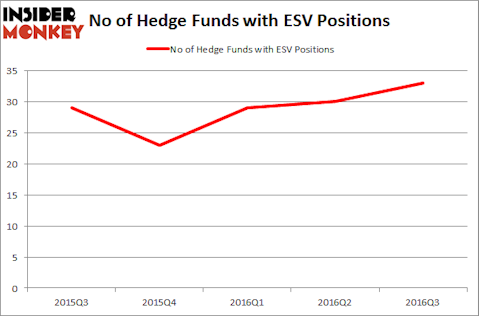

During the third quarter, the number of funds tracked by Insider Monkey long ENSCO went up by 10% to 33. With the smart money’s capital changing hands, there exists a select group of key hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Jim Simons’ Renaissance Technologies, holds the largest position in ENSCO PLC (NYSE:ESV). Renaissance Technologies has a $79.4 million position in the stock, comprising 0.1% of its 13F portfolio. On Renaissance Technologies’s heels is Citadel Investment Group, led by Ken Griffin, holding a $72.4 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions contain Dmitry Balyasny’s Balyasny Asset Management, Israel Englander’s Millennium Management, and Phill Gross and Robert Atchinson’s Adage Capital Management.

Now, some big names have been driving this bullishness. Alyeska Investment Group, managed by Anand Parekh, created the largest position in ENSCO PLC (NYSE:ESV). Alyeska Investment Group had $8.4 million invested in the company at the end of the quarter. Robert Polak’s Anchor Bolt Capital also made a $6.8 million investment in the stock during the quarter. The following funds were also among the new ESV investors: Till Bechtolsheimer’s Arosa Capital Management and Benjamin A. Smith’s Laurion Capital Management.

Let’s also examine hedge fund activity in other stocks similar to ENSCO PLC (NYSE:ESV). We will take a look at National Beverage Corp. (NASDAQ:FIZZ), Prestige Brands Holdings, Inc. (NYSE:PBH), Metals USA Holdings Corp (NYSE:MUSA), and Owens-Illinois Inc (NYSE:OI). This group of stocks’ market valuations resemble ESV’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FIZZ | 20 | 146113 | 11 |

| PBH | 17 | 204942 | -1 |

| MUSA | 19 | 169461 | -4 |

| OI | 25 | 689067 | -2 |

As you can see these stocks had an average of 20 investors with bullish positions and the average amount invested in these stocks was $302 million. That figure was $556 million in ESV’s case. Owens-Illinois Inc (NYSE:OI) is the most popular stock in this table. On the other hand Prestige Brands Holdings, Inc. (NYSE:PBH) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks ENSCO PLC (NYSE:ESV) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.