It is already common knowledge that individual investors do not usually have the necessary resources and abilities to properly research an investment opportunity. As a result, most investors pick their illusory “winners” by making a superficial analysis and research that leads to poor performance on aggregate. The Standard and Poor’s 500 Index returned 7.6% over the 12-month period ending November 21, while more than 51% of the constituents of the index underperformed the benchmark. Hence, a random stock picking process will most likely lead to disappointment. At the same time, the 30 most favored mid-cap stocks by the best performing hedge funds monitored by Insider Monkey generated a return of 18% over the same time span. Of course, hedge funds do make wrong bets on some occasions and these get disproportionately publicized on financial media, but piggybacking their moves can beat the broader market on average. That’s why we are going to go over recent hedge fund activity in Brookfield Asset Management Inc (NYSE:BAM).

Follow Brookfield Asset Management Inc (NYSE:BAM)

Follow Brookfield Asset Management Inc (NYSE:BAM)

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

Aleksandr Bagri/Shutterstock.com

Now, we’re going to check out the latest action encompassing Brookfield Asset Management Inc (NYSE:BAM).

What does the smart money think about Brookfield Asset Management Inc (NYSE:BAM)?

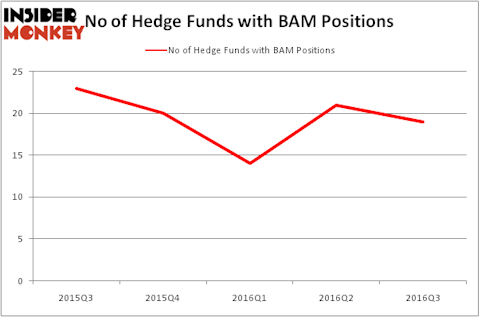

At the end of the third quarter, a total of 19 of the hedge funds tracked by Insider Monkey were long this stock, a drop of 10% from the previous quarter. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Lou Simpson’s SQ Advisors has the number one position in Brookfield Asset Management Inc (NYSE:BAM), worth close to $344.2 million, corresponding to 13.7% of its total 13F portfolio. The second largest stake is held by Glenn Greenberg of Brave Warrior Capital, with a $229.9 million position; the fund has 11.1% of its 13F portfolio invested in the stock. Remaining peers with similar optimism encompass Tom Gayner’s Markel Gayner Asset Management, Martin Whitman’s Third Avenue Management and Murray Stahl’s Horizon Asset Management.