Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

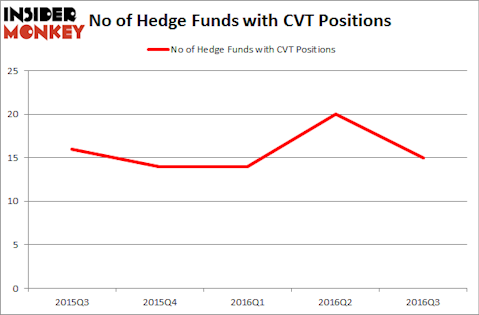

Cvent Inc (NYSE:CVT) has seen a decrease in support from the world’s most successful money managers lately. CVT was in 15 hedge funds’ portfolios at the end of the third quarter of 2016. There were 20 hedge funds in our database with CVT positions at the end of the previous quarter. At the end of this article we will also compare CVT to other stocks including TransAlta Corporation (USA) (NYSE:TAC), Advanced Energy Industries, Inc. (NASDAQ:AEIS), and Meritage Homes Corp (NYSE:MTH) to get a better sense of its popularity.

Follow Cvent Inc (NYSE:CVT)

Follow Cvent Inc (NYSE:CVT)

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Matej Kastelic/Shutterstock.com

What have hedge funds been doing with Cvent Inc (NYSE:CVT)?

Heading into the fourth quarter of 2016, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a 25% drop from the previous quarter, giving up most of the gains of the prior quarter. Below, you can check out the change in hedge fund sentiment towards CVT over the last 5 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Tom Sandell’s Sandell Asset Management has the largest position in Cvent Inc (NYSE:CVT), worth close to $24.7 million, amounting to 6.5% of its total 13F portfolio. The second most bullish fund manager is Derek C. Schrier of Indaba Capital Management, with a $18.7 million position; the fund has 7.5% of its 13F portfolio invested in the stock. Other members of the smart money with similar optimism consist of Paul Marshall and Ian Wace’s Marshall Wace LLP, Simon Davies’ Sand Grove Capital Partners, and Gordy Holterman and Derek Dunn’s Overland Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.