The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Northern Oil & Gas, Inc. (NYSEMKT:NOG) .

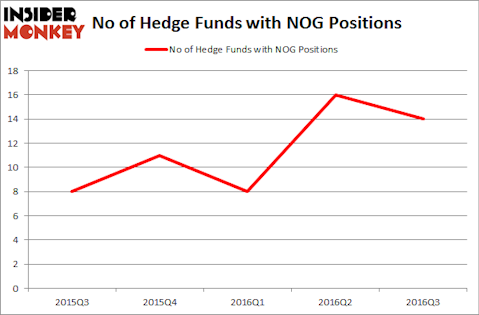

Northern Oil & Gas, Inc. (NYSEMKT:NOG) investors should be aware of a decrease in support from the world’s most successful money managers in recent months. There were 16 hedge funds in our database with NOG holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as JAKKS Pacific, Inc. (NASDAQ:JAKK), VirnetX Holding Corporation (NYSEMKT:VHC), and Townsquare Media Inc (NYSE:TSQ) to gather more data points.

Follow Northern Oil & Gas Inc.

Follow Northern Oil & Gas Inc.

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

ded pixto/Shutterstock.com

Keeping this in mind, we’re going to go over the latest action regarding Northern Oil & Gas, Inc. (NYSEMKT:NOG).

What have hedge funds been doing with Northern Oil & Gas, Inc. (NYSEMKT:NOG)?

At the end of the third quarter, a total of 14 of the hedge funds tracked by Insider Monkey were bullish on this stock, down 13% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards NOG over the last 5 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Debra Fine’s Fine Capital Partners has the most valuable position in Northern Oil & Gas, Inc. (NYSEMKT:NOG), worth close to $14.5 million, corresponding to 1.5% of its total 13F portfolio. The second most bullish fund is Renaissance Technologies, one of the largest hedge funds in the world, with a $3.4 million position; less than 0.1% of its 13F portfolio is allocated to the stock. Some other members of the smart money with similar optimism encompass Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Ken Griffin’s Citadel Investment Group and Glenn Russell Dubin’s Highbridge Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.