There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other successful funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Lithia Motors Inc (NYSE:LAD) .

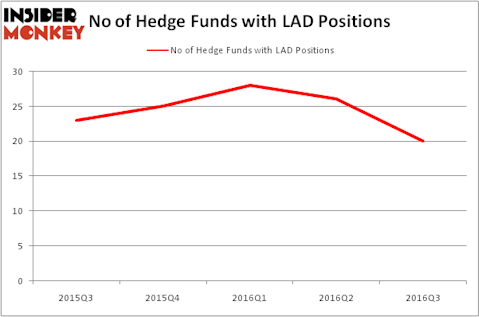

Is Lithia Motors Inc (NYSE:LAD) a worthy stock to buy now? Investors who are in the know are reducing their bets on the stock. The number of bullish hedge fund positions slashed by 6 recently. LAD was in 20 hedge funds’ portfolios at the end of September. There were 26 hedge funds in our database with LAD positions at the end of the previous quarter. At the end of this article we will also compare LAD to other stocks including Och-Ziff Capital Management Group LLC (NYSE:OZM), DiamondRock Hospitality Company (NYSE:DRH), and Community Bank System, Inc. (NYSE:CBU) to get a better sense of its popularity.

Follow Lithia Motors Inc (NYSE:LAD)

Follow Lithia Motors Inc (NYSE:LAD)

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Hedge fund activity in Lithia Motors Inc (NYSE:LAD)

At Q3’s end, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, a drop of 23% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in LAD over the last 5 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Peter S. Park’s Park West Asset Management has the number one position in Lithia Motors Inc (NYSE:LAD), worth close to $68.8 million, comprising 6.3% of its total 13F portfolio. The second most bullish fund manager is Anthony Bozza of Lakewood Capital Management, with a $61.6 million position; the fund has 1.4% of its 13F portfolio invested in the stock. Remaining members of the smart money that are bullish contain Andrew Immerman and Jeremy Schiffman’s Palestra Capital Management, Ken Griffin’s Citadel Investment Group and Amy Minella’s Cardinal Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.