World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

Hedge fund interest in American Campus Communities, Inc. (NYSE:ACC) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as NetApp Inc. (NASDAQ:NTAP), Jack Henry & Associates, Inc. (NASDAQ:JKHY), and Computer Sciences Corporation (NYSE:CSC) to gather more data points.

Follow American Campus Communities Inc (NYSE:ACC)

Follow American Campus Communities Inc (NYSE:ACC)

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Now, we’re going to review the key action encompassing American Campus Communities, Inc. (NYSE:ACC).

How are hedge funds trading American Campus Communities, Inc. (NYSE:ACC)?

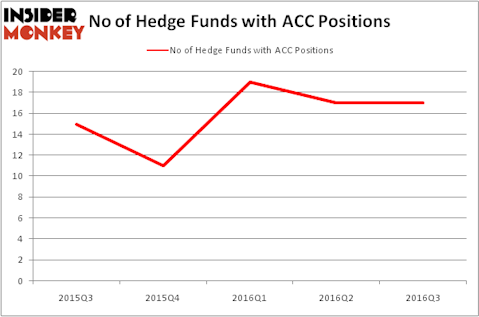

Heading into the fourth quarter of 2016, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, unchanged from the previous quarter. By comparison, 11 hedge funds held shares or bullish call options in ACC heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, AEW Capital Management, led by Jeffrey Furber, holds the biggest position in American Campus Communities, Inc. (NYSE:ACC). According to its latest 13F filing, the fund has a $54 million position in the stock, comprising 1.1% of its 13F portfolio. Sitting at the No. 2 spot is Israel Englander’s Millennium Management with a $24.5 million position; the fund has less than 0.1% of its 13F portfolio invested in the stock. Some other members of the smart money that hold long positions encompass Jim Simons’s Renaissance Technologies, Jonathan Litt’s Land & Buildings Investment Management and Greg Poole’s Echo Street Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.