The 13F season for the third quarter ended last week and, as I went through some major funds’ filings, I came across Andreas Halvorsen’s Viking Global’s form; an interesting one. As of September 30, 2014, Viking held an equity portfolio worth about $24.9 billion, with a slight focus on healthcare stocks, which comprised 31.3% of the total value of the portfolio. Although the fund made many moves over the quarter, including 24 new purchases, the increase in 19 of its preexisting stakes, and the closing of 27 of them, in this article, I would like to focus on its top 3 new positions: Alibaba Group Holding Ltd (NYSE:BABA), Citigroup Inc (NYSE:C) and Bank of New York Mellon Corp (NYSE:BK).

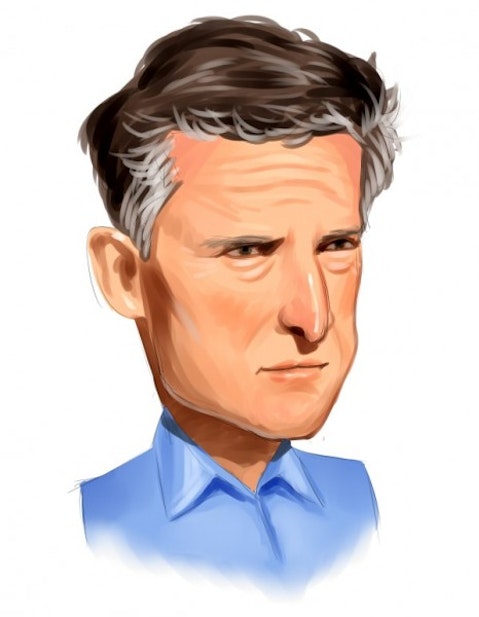

Viking Global Investors is a global investment firm founded in 1999 by Norwegian Ole Andreas Halvorsen, one of the most successful Tiger cubs, along with former Tiger employees David Ott and Brian Olson. The firm manages more than twenty billion in capital across long-short equity and long-only strategies, and has offices in Greenwich, New York City, Hong Kong, and London. As mentioned in a previous article, Mr. Olson left Viking in 2005; five years later, Mr. David Ott did the same. Between June 2005 (when Ott became the CIO of Viking) and March 2010, Viking Global returned 119% vs. 11% for the MSCI World Index.

Like many other hedge funds this quarter (109 out of the more than 700 that we track, to be precise), Viking Global started a position in the recently-public Alibaba Group Holding Ltd (NYSE:BABA), the mega-cap online and mobile commerce company. This stake comprises its largest new bet: 11.38 million shares are worth more than $1 billion, and account for more than 4% of its total equity portfolio.

This wage makes of Viking Global the largest institutional investor, amongst those we track, in Alibaba Group Holding Ltd (NYSE:BABA). Other major investors betting on the company are Dan Loeb’s Third Point, with 7.2 million shares; Julian Robertson’s Tiger Management, which owns about 1.21 million shares; and George Soros’ Soros Fund Management, which holds 4.4 million shares of the Internet company.

Mr. Halvorsen’s second-largest new wage was placed on Citigroup Inc (NYSE:C), the –also- mega-cap diversified, global financial services holding company. According to the 13F filing, the firm acquired 14.9 million shares of Common Stock (New), worth about $772 million.

Citigroup Inc (NYSE:C) is also amongst hedge funds’ favorites for the third quarter. In fact, it was the most popular financial stock amongst hedge funds, with – at least – 131 institutional supporters. One of the largest shareholders is Boykin Curry’s Eagle Capital Management, which held 26.79 million shares as of the end of September.

Last in Viking Global’s new picks list is Bank of New York Mellon Corp (NYSE:BK), a $45 billion market cap global investment company that saw the firm purchase 16.73 million shares of Common Stock over the third quarter.

This stake is worth roughly $648 million, and makes of Viking Global one of the largest institutional investors in Bank of New York Mellon Corp (NYSE:BK), surpassed however by a few funds, including Jean-Marie Eveillard’s First Eagle Investment Management, which disclosed ownership of 27.71 million shares.

Over the fourth quarter, Viking Global also initiated a position (with 12.6% of the stock) in Wayfair Inc (NYSE:W), a recently-public company, and continued to raise its bets over November, taking its holdings to 668,760 shares of Class A Common Stock, and 1.58 million shares of Class B Common Stock.

Disclosure: Javier Hasse holds no positions in any stocks or funds mentioned.